The Impact of the European Court of Human Rights' Case-Law on National Authorities' Response to Tax Criminal Offences

The Impact of the European Court of Human Rights' Case-Law on National Authorities' Response to Tax Criminal Offences

Author(s): Dragoș PârgaruSubject(s): Criminal Law, International Law, Human Rights and Humanitarian Law, EU-Legislation, Court case

Published by: Centrul de Studii Internationale

Keywords: human rights; tax criminal offence; tax fraud; administrative proceedings; criminal charge; ne bis in idem; double jeopardy;

Summary/Abstract: In this article, the author will extract from the European Court of Human Rights' case-law a selection of principles which are particularly important in the proceedings leading to punishing taxpayers' misconducts. Noting that general human rights principles are equally applicable in criminal proceedings relating to tax frauds, we do observe that, in the relevant case-law concerning such conducts, leading jurisprudence revolved around aspects as the applicability of the "criminal limb" of art. 6 of the Convention to tax misconduct and the effects of ne bis in idem in cases where both the tax authorities and the criminal courts have been involved in separate proceedings. Critical analysis of relevant case-law will reveal both clear and foreseeable criteria set out by the European Court of Human Rights, on one hand, and assessments that could lead to arbitrary future application of the Convention, on the other hand.

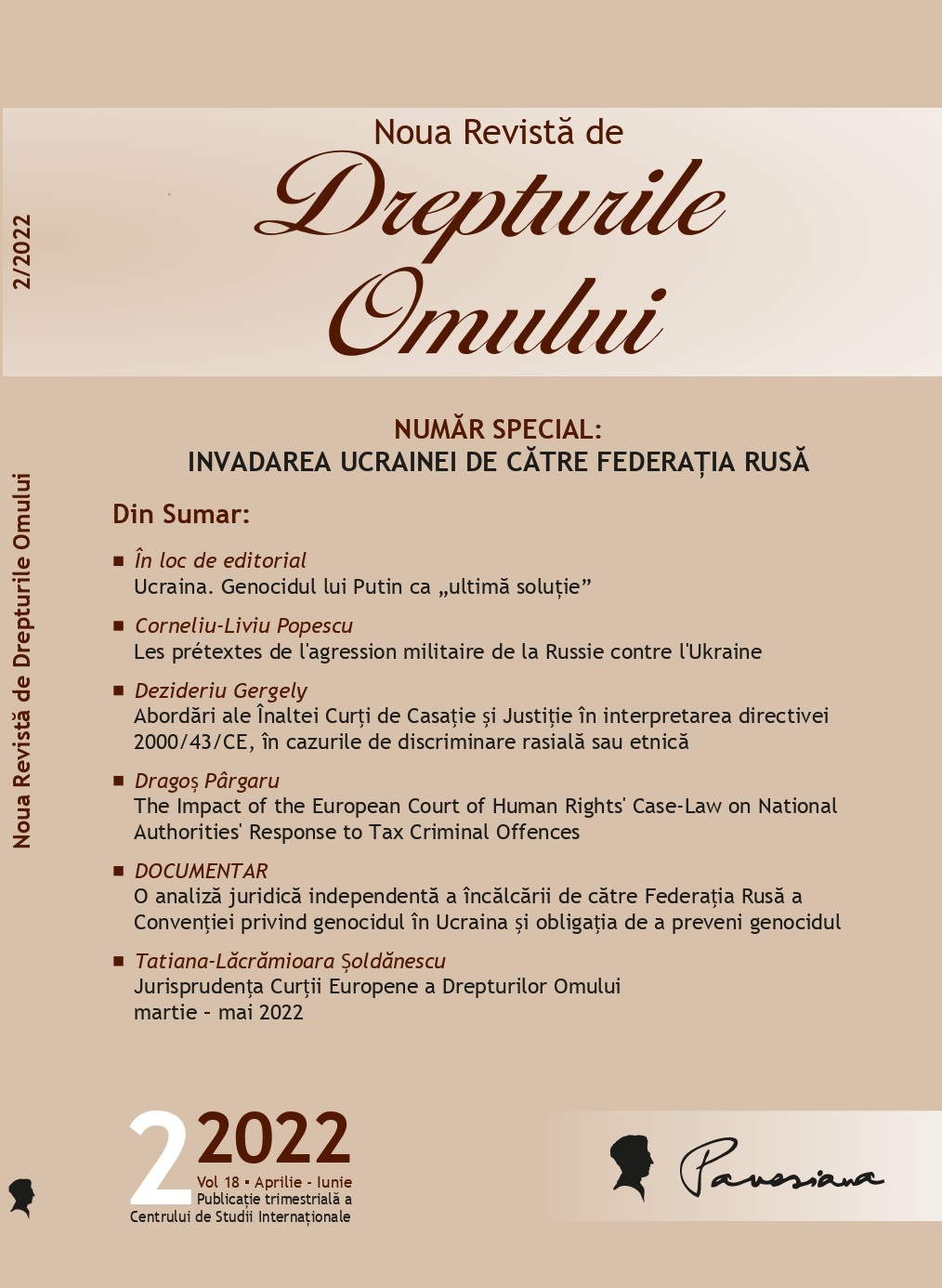

Journal: Noua Revistă de Drepturile Omului

- Issue Year: 18/2022

- Issue No: 2

- Page Range: 61-75

- Page Count: 15

- Language: English