Zasada ochrony uzasadnionych oczekiwań. Refleksje na gruncie prawa podatkowego

The principle of legitimate expectations. Reflections on the basis of tax law

Author(s): Agata Ćwik-BurySubject(s): Law, Constitution, Jurisprudence, Law on Economics, Fiscal Politics / Budgeting

Published by: Wydawnictwo Uniwersytetu Łódzkiego

Keywords: legitimate expectations; legal protection; tax law

Summary/Abstract: The article deals with the subject of the legal protection of a taxpayer, which is based on the principle of legitimate expectations according to the European Court of Justice case law. The author stresses that case law formulates assertion of the right to rely on the principle of the protection of legitimate expectations, which extends to any taxable person in a situation in which an administration authority has caused that person to entertain expectations which are justified by precise assurances provided to him.

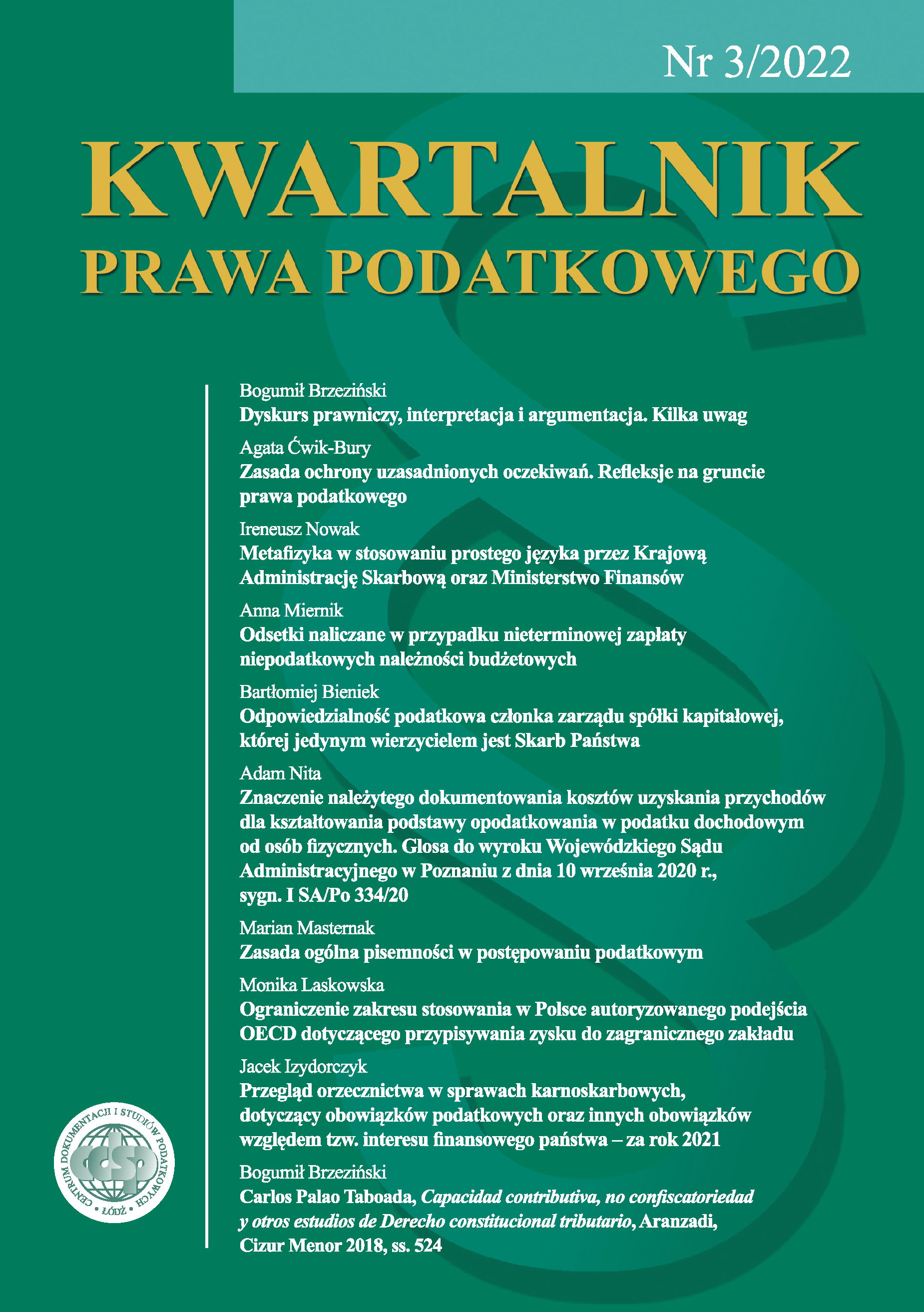

Journal: Kwartalnik Prawa Podatkowego

- Issue Year: 2022

- Issue No: 3

- Page Range: 23-49

- Page Count: 27

- Language: Polish