The Constitutionalisation of the Tax Sovereignty of European Autonomous Territories

The Constitutionalisation of the Tax Sovereignty of European Autonomous Territories

Author(s): Monika Bogucka-Felczak, Patryk KowalskiSubject(s): Law, Constitution, Jurisprudence

Published by: Wydawnictwo Uniwersytetu Łódzkiego

Keywords: autonomous territory; tax sovereignty; territorial autonomy; taxes; constitution

Summary/Abstract: This article presents the results of a comparative legal research concerning tax sovereignty granted to 13 European autonomous territories by constitutional law. Research material includes the constitutions of the main states and legal acts constituting the autonomous territories as well as selected scientific publications in the field of tax sovereignty and territorial autonomy. The most important research findings are as follows: tax sovereignty has been constitutionalised for the vast majority of European autonomous territories (11 out of 13); tax sovereignty has been regulated in only 2 constitutions (but in relation to 7 autonomous territories); the scope of granted tax sovereignty differs between the autonomous territories (some norms indicate the structural elements of the tax, while others define tax sovereignty in very general terms); the provisions granting tax sovereignty are protected against amendment, but, in principle, the approval of the central state is required; Madeira and the Azores are, in the opinion of the authors, characterised by the highest level of constitutionalisation in terms of tax sovereignty.

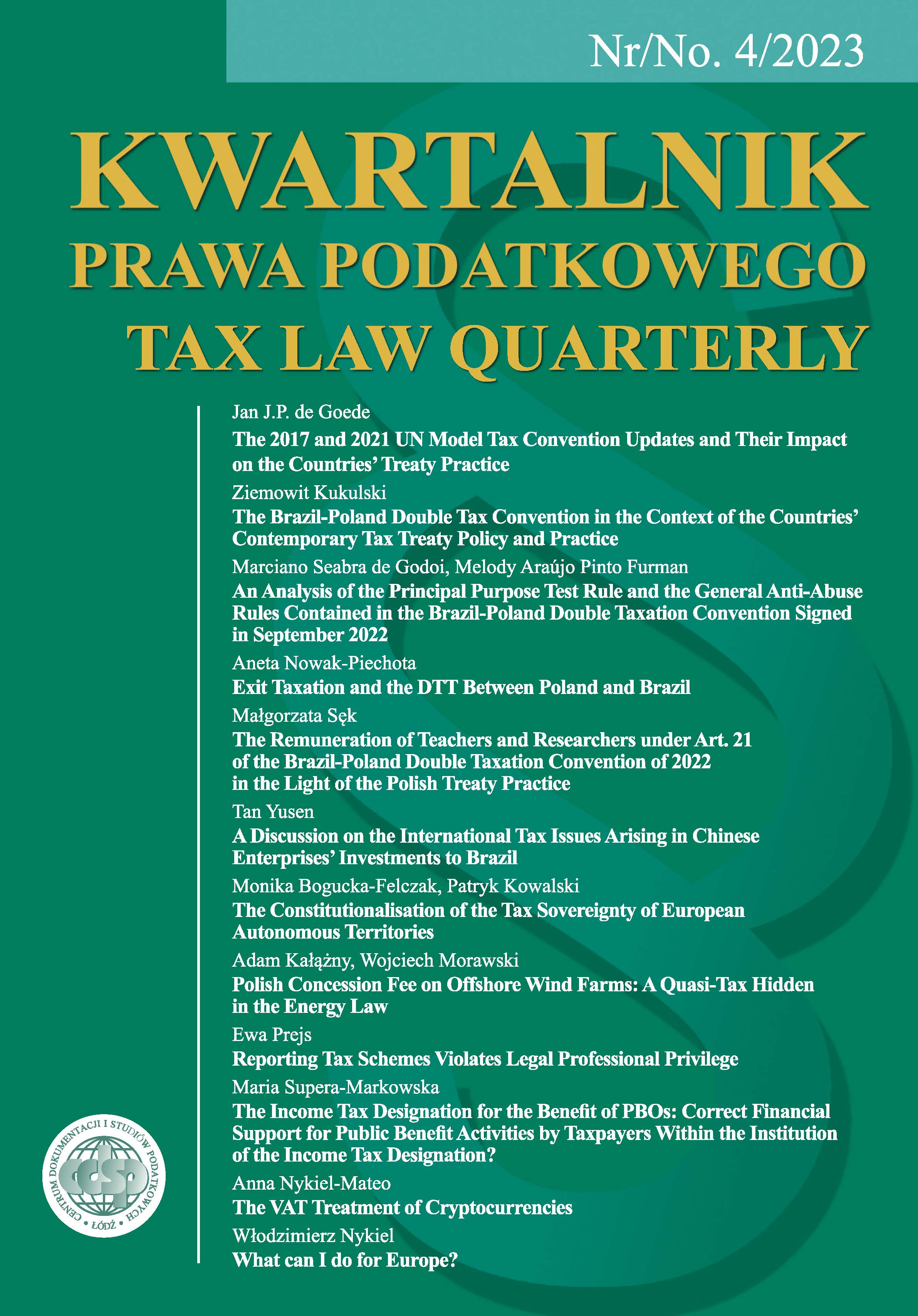

Journal: Kwartalnik Prawa Podatkowego

- Issue Year: 2023

- Issue No: 4

- Page Range: 121-142

- Page Count: 22

- Language: English