The VAT Treatment of Cryptocurrencies

The VAT Treatment of Cryptocurrencies

Author(s): Anna Nykiel-MateoSubject(s): Law, Constitution, Jurisprudence

Published by: Wydawnictwo Uniwersytetu Łódzkiego

Keywords: VAT; cryptocurrency; tax exemptions; currencies transactions; payment or transfer transactions; Hedqvist

Summary/Abstract: Since their creation in 2009, crypto-assets have evolved from niche products into assets held and used much more widely. These assets pose challenges for policymakers and tax administrations, because, as pointed out by the OECD, they can be transferred and held without the participation of traditional financial intermediaries and without central administrators being aware of the transactions carried out or the location of crypto-assets holdings. On the indirect taxation side, the VAT Committee discussed the issues relating to the VAT treatment of crypto-assets and, in particular, of cryptocurrencies, on several occasions. The discussion on the most recent of the working papers on this subject, No. 1037 on the VAT treatment of crypto-assets, resulted in the adoption of the Guidelines which aim at harmonising tax administrations’ practice regarding the VAT implications of the different transactions linked to crypto-assets. The article highlights the main challenges posed by cryptocurrencies in terms of VAT while focusing on the main supplies with the use of cryptocurrencies and their qualification for the VAT purposes. Those transactions range from the creation, verification, validation, and supply of cryptocurrencies through their modification, storage, transfer, to exchange. The article explains in this context the position of the VAT Committee reflected in the Guidelines.

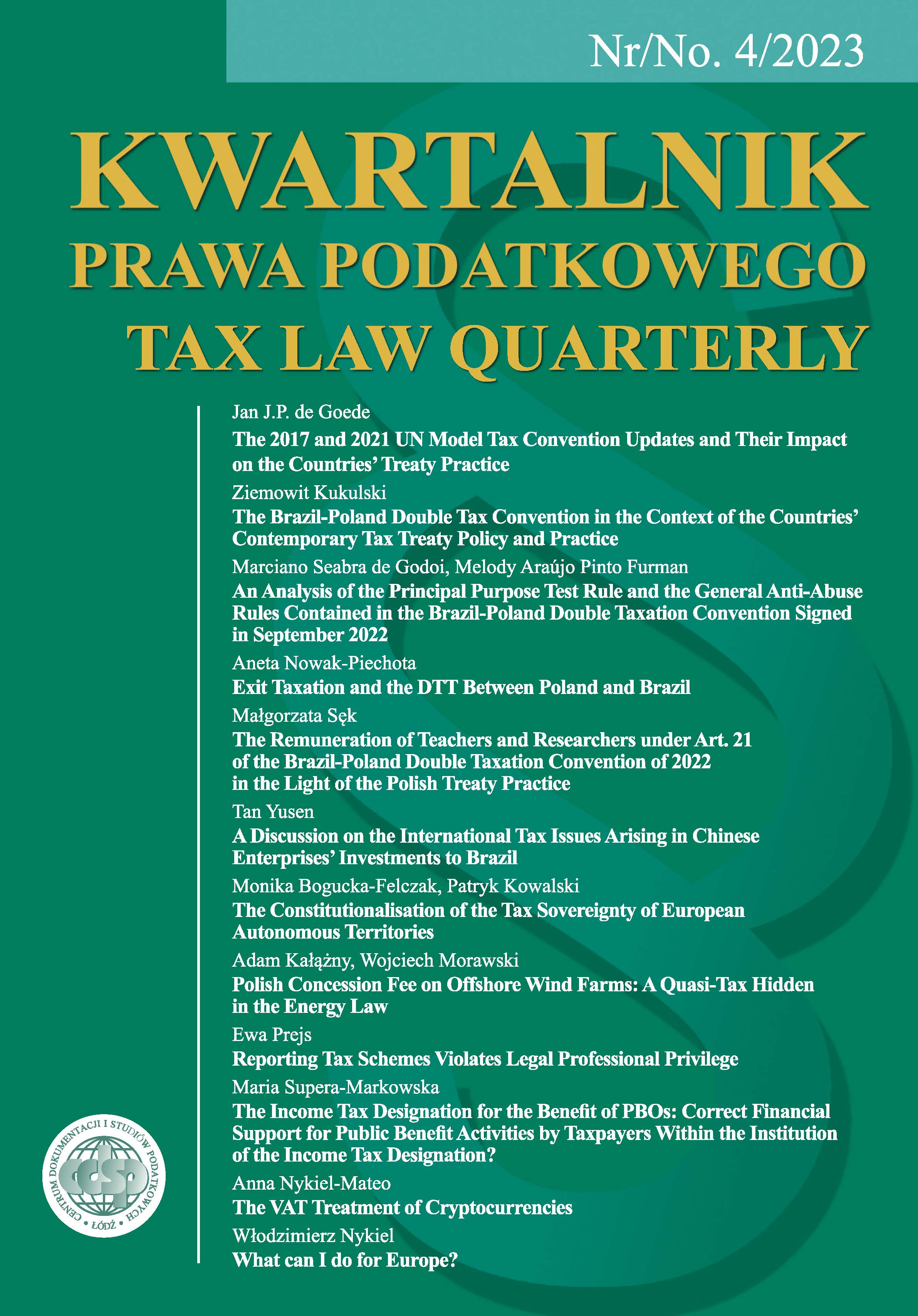

Journal: Kwartalnik Prawa Podatkowego

- Issue Year: 2023

- Issue No: 4

- Page Range: 209-226

- Page Count: 18

- Language: English