Designing a Revenue Structure in Local Self-government Entities in Poland: Taxes Versus Grants

Designing a Revenue Structure in Local Self-government Entities in Poland: Taxes Versus Grants

Author(s): Beata GuziejewskaSubject(s): Economy, Public Finances

Published by: Instytut Badań Gospodarczych

Keywords: public finance; fiscal relations; grants; local taxes; self-government finance

Summary/Abstract: This paper discusses the problem of rational forming of the financing system for local self-government entities. The concept of fiscal federalism as well as the role and importance of own revenues and revenues from the state budget transfers, which are slightly different from other unitary countries, have been referred to in this context. The aim of this paper is to statistically analyze the selected categories of local self-government revenues in Poland with regard to the local self-government total revenue in 2013 and the total expenditure between 1999 and 2013. The study involved methods for the analysis of dynamics of mass phenomena such as, first of all, fixed base indexes, the average rate of change indicator and the correlation and regression coefficients from time series. The correlation and regression coefficients from time series were calculated with the first difference method. The results of study demonstrate a statistically significant role of transfer revenues in the expenditure (with the exception of voivodeships) and a statistically insignificant effect of sensu stricto own revenues in the case of cities with poviat status, poviats and voivodeships. The results reveal that the spending policy of local self-governments in Poland is highly dependent on a specific category of revenue, which is referred to as “other revenue” in the study, as a result of the inflow of EU funds. In the long term, once this specific, incidental source of revenue has been exhausted, the local self-government finance may face serious disruption. Such conclusions may serve as a practical contribution to the creation of an early warning mechanism in the shaping of present and future fiscal policies.

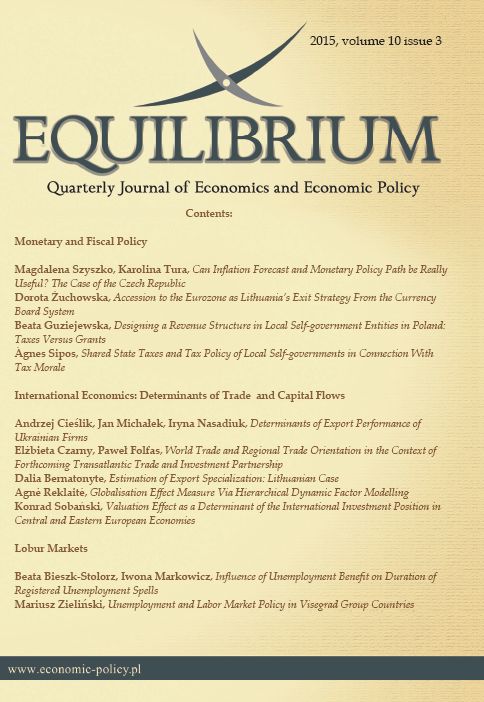

Journal: Equilibrium. Quarterly Journal of Economics and Economic Policy

- Issue Year: 10/2015

- Issue No: 3

- Page Range: 45-63

- Page Count: 18

- Language: English