Câteva observaţii privind modificările aduse de Ordonanţa de urgenţă a Guvernului nr. 52/2016 privind contractele de credit oferite consumatorilor pentru bunuri imobile, în materia cesiunii unor creanţe bancare

Some remarks regarding the amendments brought by the Government emergency Ordinance no. 52/2016 regarding the loan agreements provided to consumers for immovable assets, in the matter of assignment of certain bank receivables

Author(s): Florina PopaSubject(s): Law, Constitution, Jurisprudence

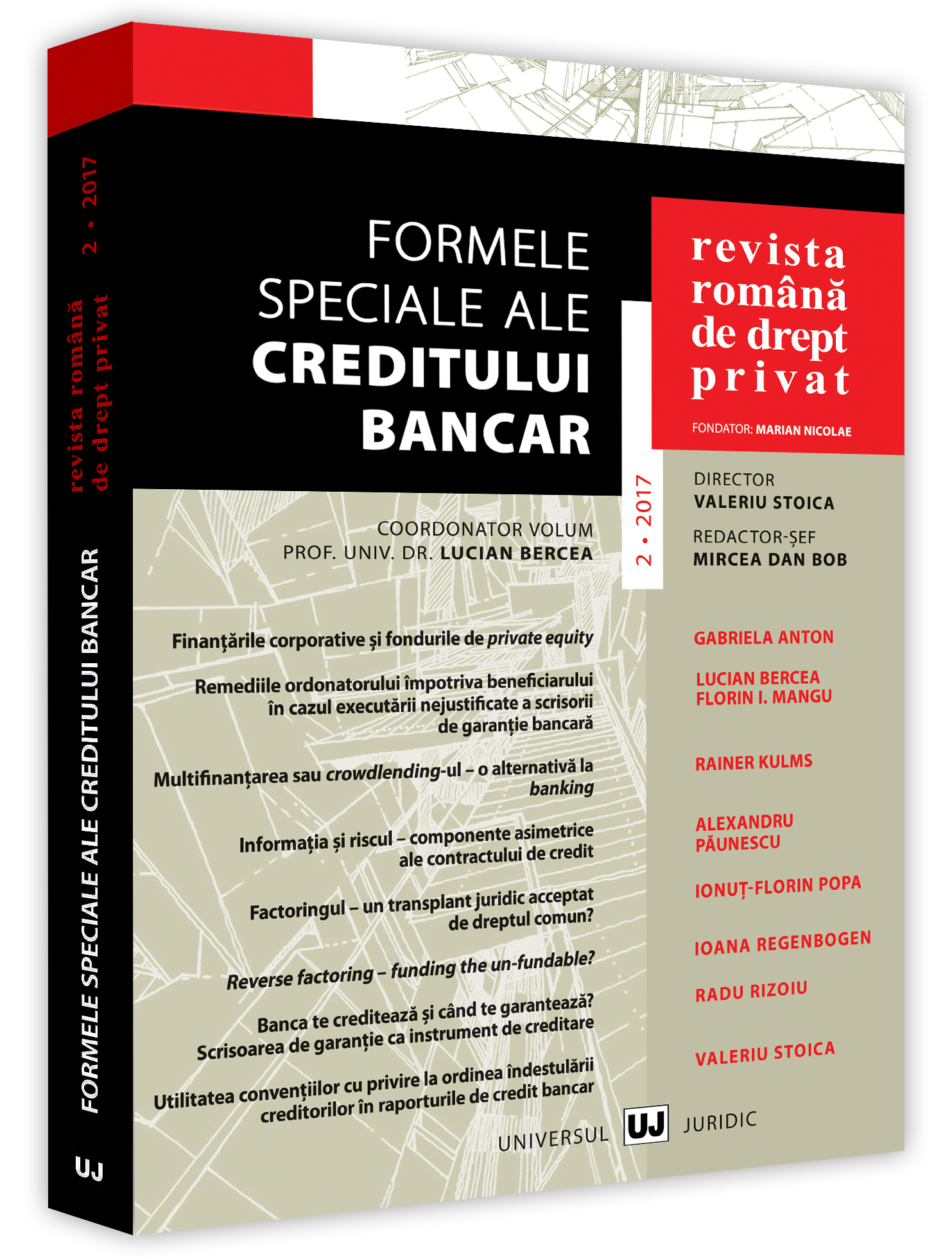

Published by: Universul Juridic

Keywords: assignment of non-performing loans; debt collector entities; forced execution against debtor consumers;

Summary/Abstract: The recent practice of assignment of non-performing loans from credit institutions to debt collector entities has led to strong controversy over the legality of these operations, both from the perspective of the general rules of law, and from the perspective of the specific legislation. No doubt, however, the fiercest dispute concerned the possibility for the assignee to initiate the procedures of forced execution against the debtor, without having to resort to any formalities other than those to which the assignor would have recourse: which one is enforceable, the contract or the claim? Is the enforceable character lost by way of assignment or not? Prior to the entry into force of the Government Emergency Ordinance no. 52/2016, the issue of assignment of bank loans was regulated rather superficially, leaving room for interpretation, which led to the assignment of claims to various entities having the purpose of collecting debts, and which, relying on legislative ambiguities, have created abusive practices in the procedures of forced execution against consumers. The provisions of GEO 52/2016 have established clear consumer protection rules, disciplining the activity of debt collector entities with regard to the assignment of bank loans, and setting up a new legislative framework, aimed at establishing a balance in the contractual relationship between the debtor consumers and the creditors, assignees of the bank loans.

Journal: Revista Română de Drept Privat

- Issue Year: 2017

- Issue No: 02

- Page Range: 84-94

- Page Count: 11

- Language: Romanian

- Content File-PDF