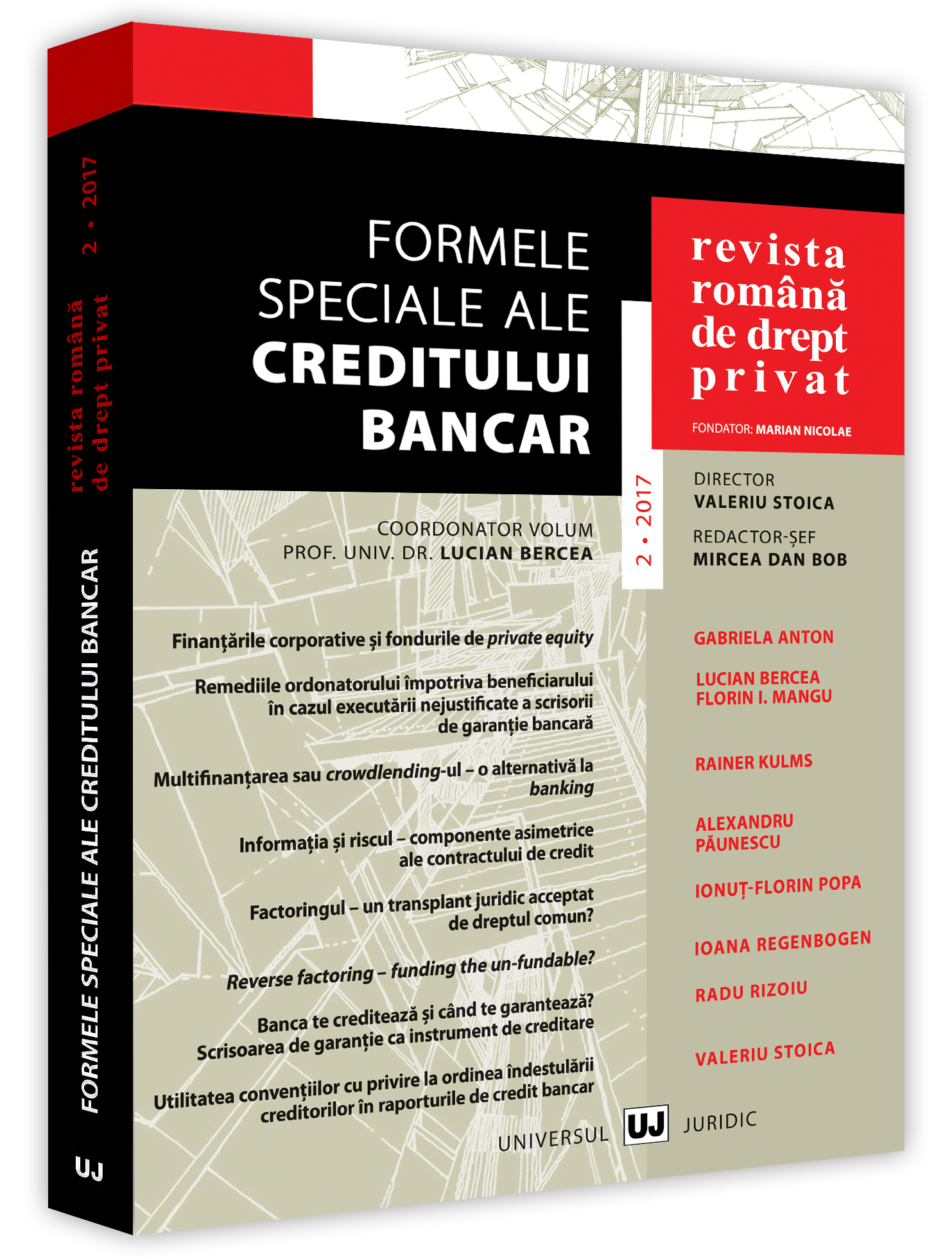

Banca te creditează şi când te garantează? Scrisoarea de garanţie ca instrument de creditare

The bank gives you credit even when it gives you a guarantee? The letter of guarantee as a credit device

Author(s): Radu RizoiuSubject(s): Law, Constitution, Jurisprudence

Published by: Universul Juridic

Keywords: letter of guarantee; independent guarantee; credit facility; bank recourse; subrogation;

Summary/Abstract: This paper focuses on the bank independent guarantee as a facility agreement between the client and the bank. The main question to be answered is what type of obligation the client undertakes towards the bank that the bank could ask security for. In order to determine the legal nature of such obligation, the paper starts from the current statutory regulation of the letter of guarantee under the New Romanian Civil Code by presenting it as a default rule that could be varied by the parties in most areas (except those governed by mandatory rules, such as the abusive demand matters). The argument then moves to the consideration for issuing the letter of guarantee by the bank. Far from being an abstract contract, the guarantee has its cause in the agreement between the client and the bank. This is the source of the bank’s obligation to issue the independent guarantee and it represents a facility agreement whereby the bank extends (conditional) credit to the client. From the fact that bank’s obligation to pay the beneficiary upon its simple demand is unconditional while the obligation of the client to repay the bank is conditional it results that there are several grey areas where the client’s obligation under the facility agreement could be terminated before the banks recourse become actual. This is the case when the bank refuses to pay upon a demand from the beneficiary and the latter obtains later on a court order forcing the bank to pay. If at that time the client no longer had a valid agreement with the bank, the recourse will not be based on the contract, but rather on the legal provisions to this effect. Whether such provisions allow the bank to step into the shows of the beneficiary by way of subrogation is under debate. It looks like in all cases the bank pays another party’s debt and, as such, would have a right of subrogation.

Journal: Revista Română de Drept Privat

- Issue Year: 2017

- Issue No: 02

- Page Range: 127-143

- Page Count: 17

- Language: Romanian

- Content File-PDF