Cota TVA de 5% la produse bio: cum o aplicăm?

5% VAT rate on organic products: how do we apply it?

Author(s): Cosmin Preda, Mihaela ArdeleanuSubject(s): Law on Economics, Commercial Law

Published by: Editura Solomon

Keywords: VAT; VAT rate; 5% VAT rate; organic products;

Summary/Abstract: Since 2010, The Organization for Economic Cooperation and Development has started to develop reports which focus on health issues of the EU members. According to the data records offered by the two institutions on that time, Romania is among the states with the biggest issues in this area (as exemple, we can consider the low number of doctors per citizen, health costs under the averge of EU per citizen, the high rate of mortality etc.) Recently, this statistics raised a concern also for the Romanian legislator, this being a reason for the OUG no. 31/2019, which was approved on May, this year. Through OUG no. 31/2019, the VAT rate is decreased from 9% to 5% for delivery of mountain, bio or traditional products, measure which has as final purpose „a smooth access of the population to healthy products, of high quality, according to the Foundation Note”. It is possible for this concern to be the reason why the OUG passed from the phase of a project presented for public debate to the final form approved and implemented in less than one month? The main goal of the below article is to present the way and conditions through which the new VAT rate is applicable among the entire distribution chain of this products and the practical issues that could arise because of this law implemented in less than one month.

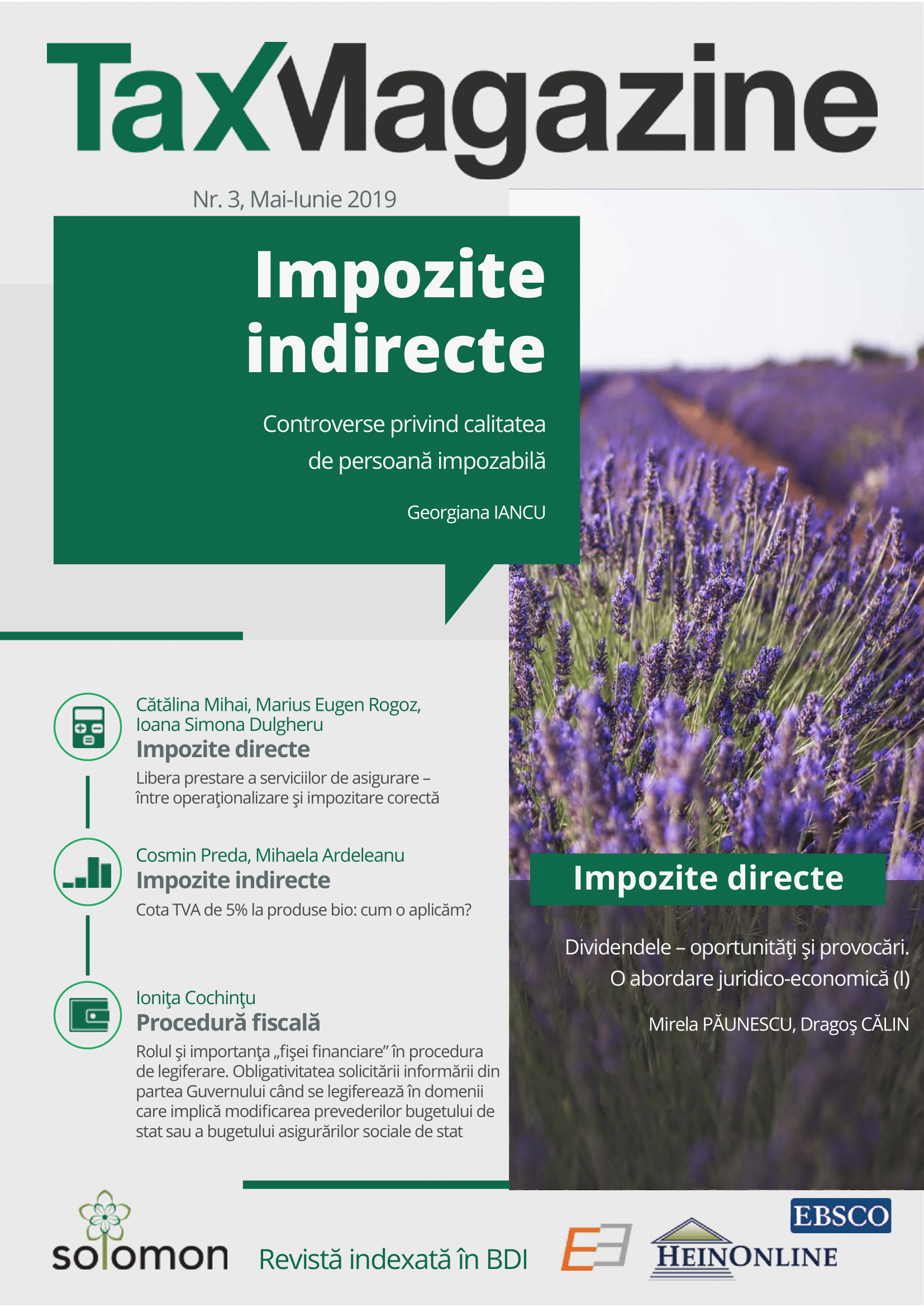

Journal: Tax Magazine

- Issue Year: 2019

- Issue No: 3

- Page Range: 214-218

- Page Count: 5

- Language: Romanian

- Content File-PDF