Măsuri fiscale în timpul pandemiei COVID-19

Tax measures during COVID-19 pandemic

Author(s): Marilena EneSubject(s): Law on Economics

Published by: Editura Solomon

Keywords: COVID-19 pandemic; Tax measures;

Summary/Abstract: For all us currently working, but also for those who have already retired, the period we are going through is extraordinary. We have never experienced a pandemic and an economic crisis at the same time. Or containment measures. Fortunately, containment is imposed in a democratic regime. From an economic perspective, the situation we are going through will have as an impact a reduction in GDP of at least 4%, if we take into account that the OECD has calculated that for each month of containment the GDP decreases by 2%. The analysis of the fiscal measures adopted during this time has on the one hand the purpose of writing a piece of our fiscal history, but also to present each of the measures and their effects if possible. However, to clarify the terminology used in the legislation adopted since March 2020 in Romania, the virus is SARS-CoV-2, from the coronavirus family, and the disease produced by this virus is COVID-19, so we adopt measures to limit the spread of SARS-CoV-2 and to combat the effects of COVID-19.

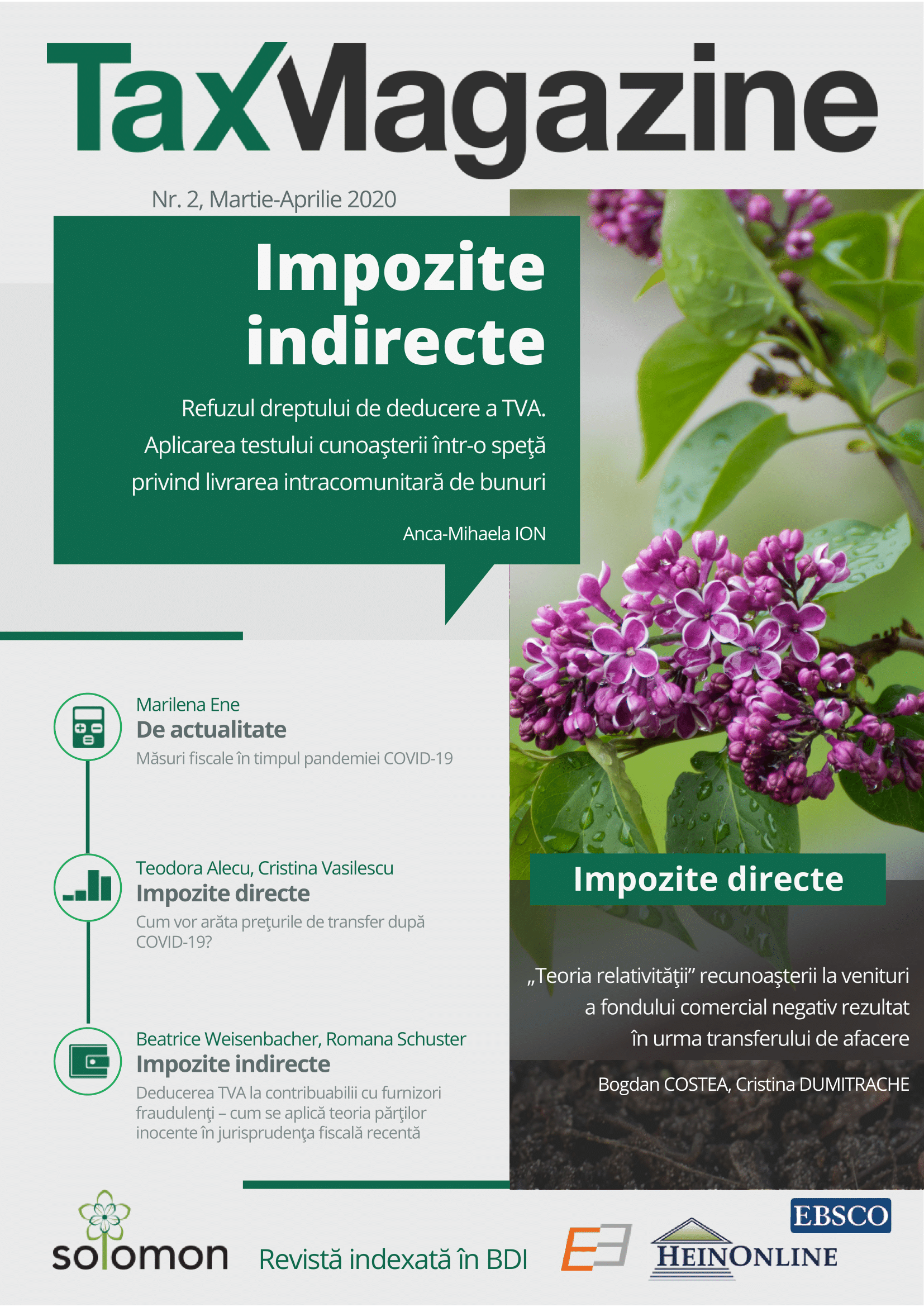

Journal: Tax Magazine

- Issue Year: 2020

- Issue No: 2

- Page Range: 90-98

- Page Count: 9

- Language: Romanian

- Content File-PDF