Unele considerații cu privire la posibila neconstituționalitate și nelegalitate a unora dintre precizările din Comunicatul ANAF referitor la bonificațiile la impozitul pe profit în perioada crizei COVID-19

Some considerations regarding the possible unconstitutionality and illegality of some of the clarifications in the ANAF Communiqué regarding the profit tax rebates during the COVID-19 Crisis

Author(s): Dan Dascălu, Mihail Boian, Andrei IancuSubject(s): Law on Economics, Commercial Law

Published by: Editura Solomon

Keywords: tax measures; payment bonuses; profit tax;

Summary/Abstract: Among the legislative measures taken by Romania in the context of the COVID-19 crisis, GEO no. 33/2020 aroused particular interest in the business environment because, unlike the exclusively passive nature of tax measures taken by other regulations, the payment bonuses provided by it imply the involvement of taxpayers in support of the State in this difficult period. The legal texts included in the Ordinance have already aroused debates regarding the application of the bonuses also for those entitled to the compensation of the obligations due to the profit tax. Such an expectation exists in particular for those who have been in a position to refund the income tax for 2019, as a result of the annual declaration registered until March 25, 2020. At the same time, the application of the bonus for taxpayers who have another fiscal year than the calendar one provoked some discussions in practice. The ANAF communiqué doesn’t produce binding legal effects for taxpayers. To the extent that they don’t agree with the interpretation it contains, they are left with the possibility to apply the bonus, in the hope that the criticized solution will be corrected upon approval by law.

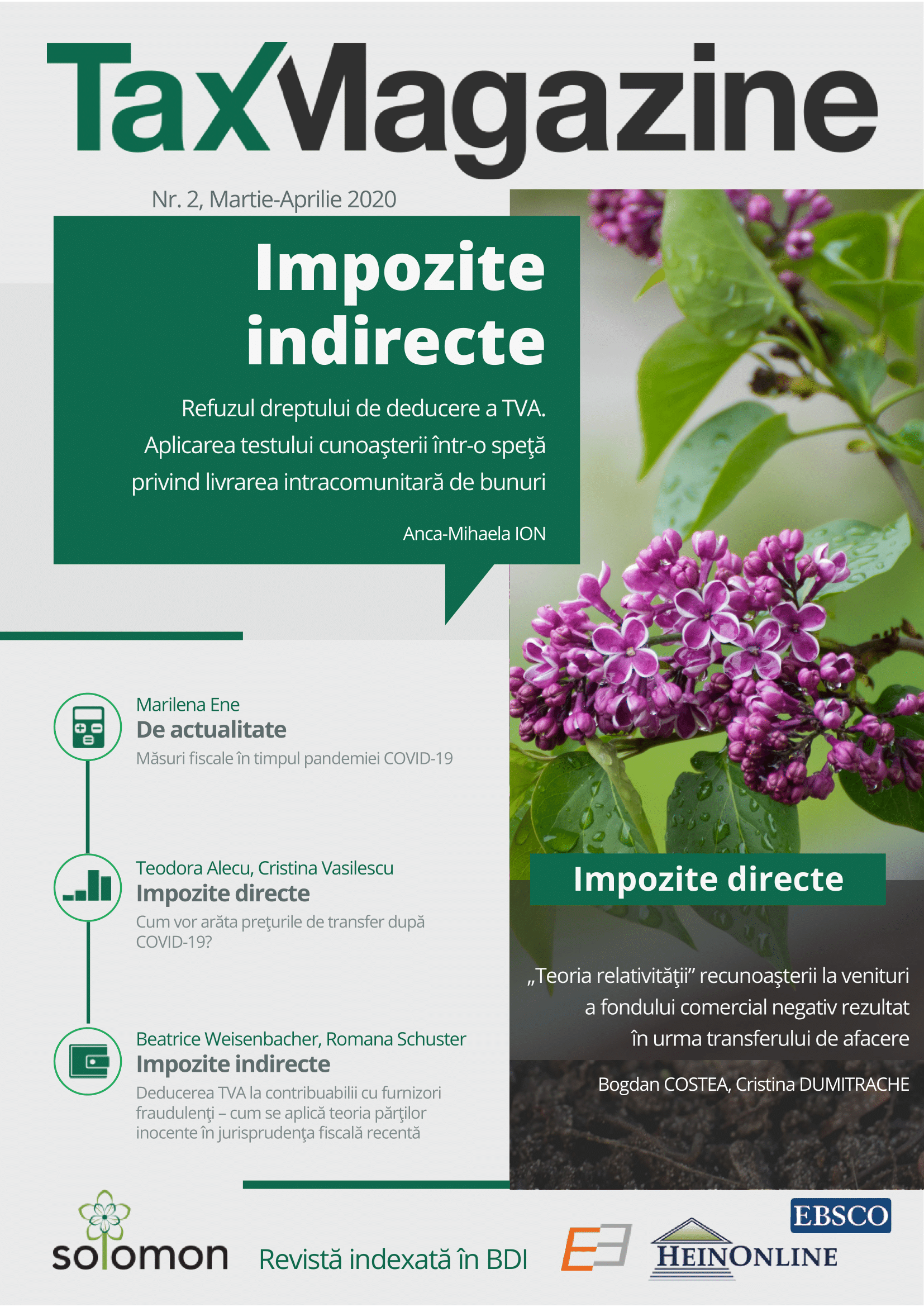

Journal: Tax Magazine

- Issue Year: 2020

- Issue No: 2

- Page Range: 99-105

- Page Count: 7

- Language: Romanian

- Content File-PDF