INCOME TAX ASPECTS OF CRYPTOCURRENCIES – LEGAL AND YOUNG ECONOMISTS’ VIEW IN THE CZECH REPUBLIC

INCOME TAX ASPECTS OF CRYPTOCURRENCIES – LEGAL AND YOUNG ECONOMISTS’ VIEW IN THE CZECH REPUBLIC

Author(s): Filip HamplSubject(s): Education, National Economy, Supranational / Global Economy, Business Economy / Management

Published by: Udruženje ekonomista i menadžera Balkana

Keywords: Personal Income Tax; Act on Income Taxes; Natural Person; Survey; Thing in a Legal Sense; Virtual Currencies

Summary/Abstract: Cryptocurrencies are used not only as a payment instrument but also as a speculative and investment instrument. In the context of their use, the question arises of how and whether they should be taxed. The aim of the paper is to analyse and to assess the taxation of income from the cryptocurrency operations from the perspective of a non-business natural person in compliance with the Act on Income Taxes in the Czech Republic, concurrently to find out the attitude of young future economists familiar with cryptocurrencies to this tax issue and to identify socioeconomic factors influencing their attitude. For this purpose, an online questionnaire survey was conducted among economists aged 19-35 years in May 2019. A total of 269 responses were obtained and evaluated using descriptive statistics and ordinal regression. While, according to the effective law, income from all cryptocurrency operations is to be taxed, the results show that most of the respondents (44.98%) would tax the income depending on how cryptocurrencies are used.

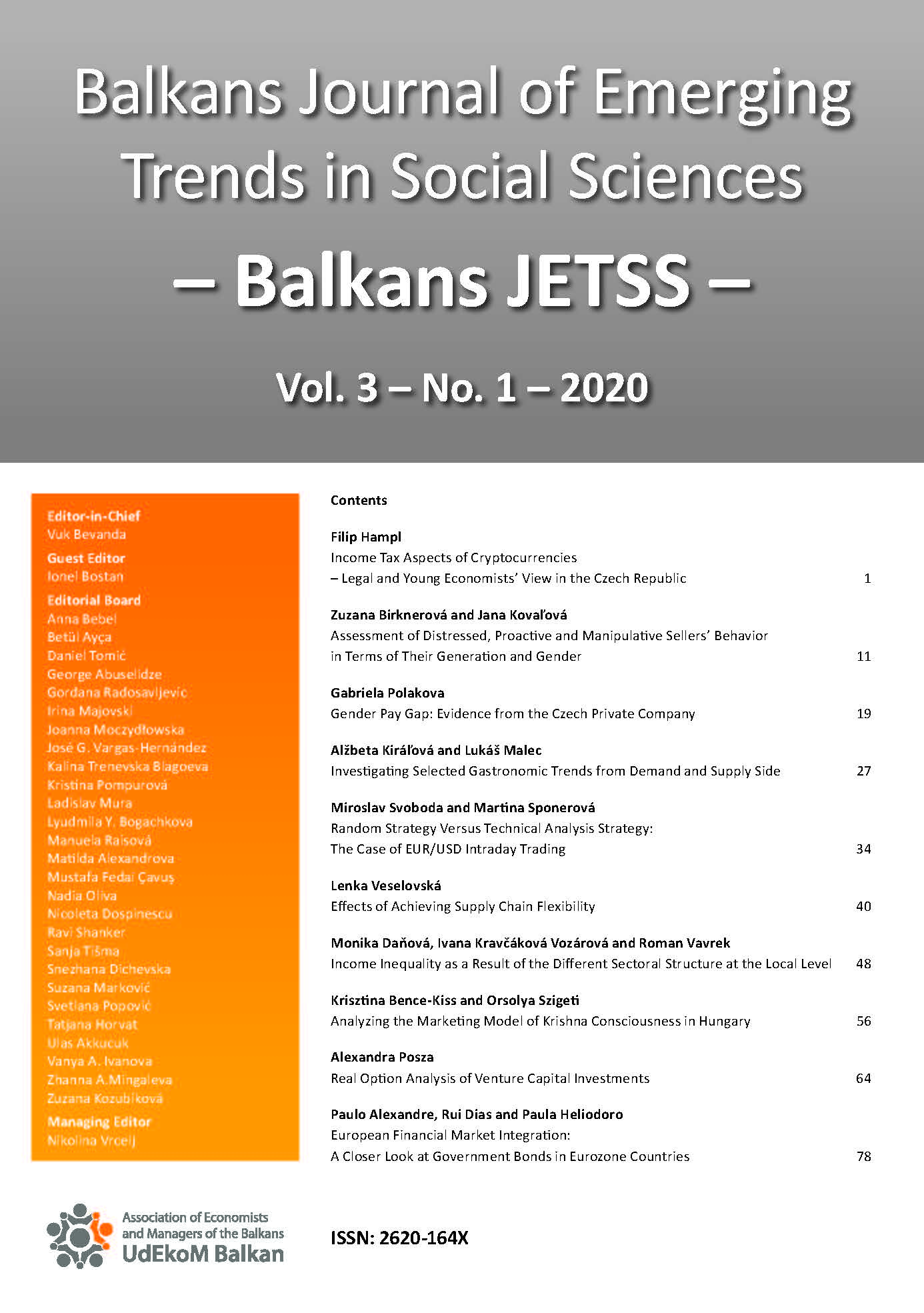

Journal: Balkans Journal of Emerging Trends in Social Sciences Balkans JETSS

- Issue Year: 3/2020

- Issue No: 1

- Page Range: 1-10

- Page Count: 10

- Language: English