RANDOM STRATEGY VERSUS TECHNICAL ANALYSIS STRATEGY: THE CASE OF EUR/USD INTRADAY TRADING

RANDOM STRATEGY VERSUS TECHNICAL ANALYSIS STRATEGY: THE CASE OF EUR/USD INTRADAY TRADING

Author(s): Miroslav Svoboda, Martina SponerováSubject(s): National Economy, Business Economy / Management, Financial Markets, Accounting - Business Administration

Published by: Udruženje ekonomista i menadžera Balkana

Keywords: Investment Decisions; Foreign Exchange Markets; Currency Markets; Moving Average; Backtesting; Intraday Trading

Summary/Abstract: This paper provides a comparison between the strategy based on technical analysis and the strategy based on random trading on a highly liquid EUR/USD foreign exchange market. The authors analyze three years of data, and in every intraday trading session. Technical analysis strategy uses essential indicators such as moving averages (MA). Every trading position will have the risk-reward ratio (RRR) 3 to 1. In addition, another trading positions on the EUR/USD currency pair will be opened at the same time each day, without technical analysis. The time of entry into position will be indicated by past high liquidity on a given currency pair at a given time with a similar risk-reward ratio (RRR) 3 to 1. This paper aims to compare the strategy of technical analysis and the random strategy in intraday trading concerning the profitability of these trades.

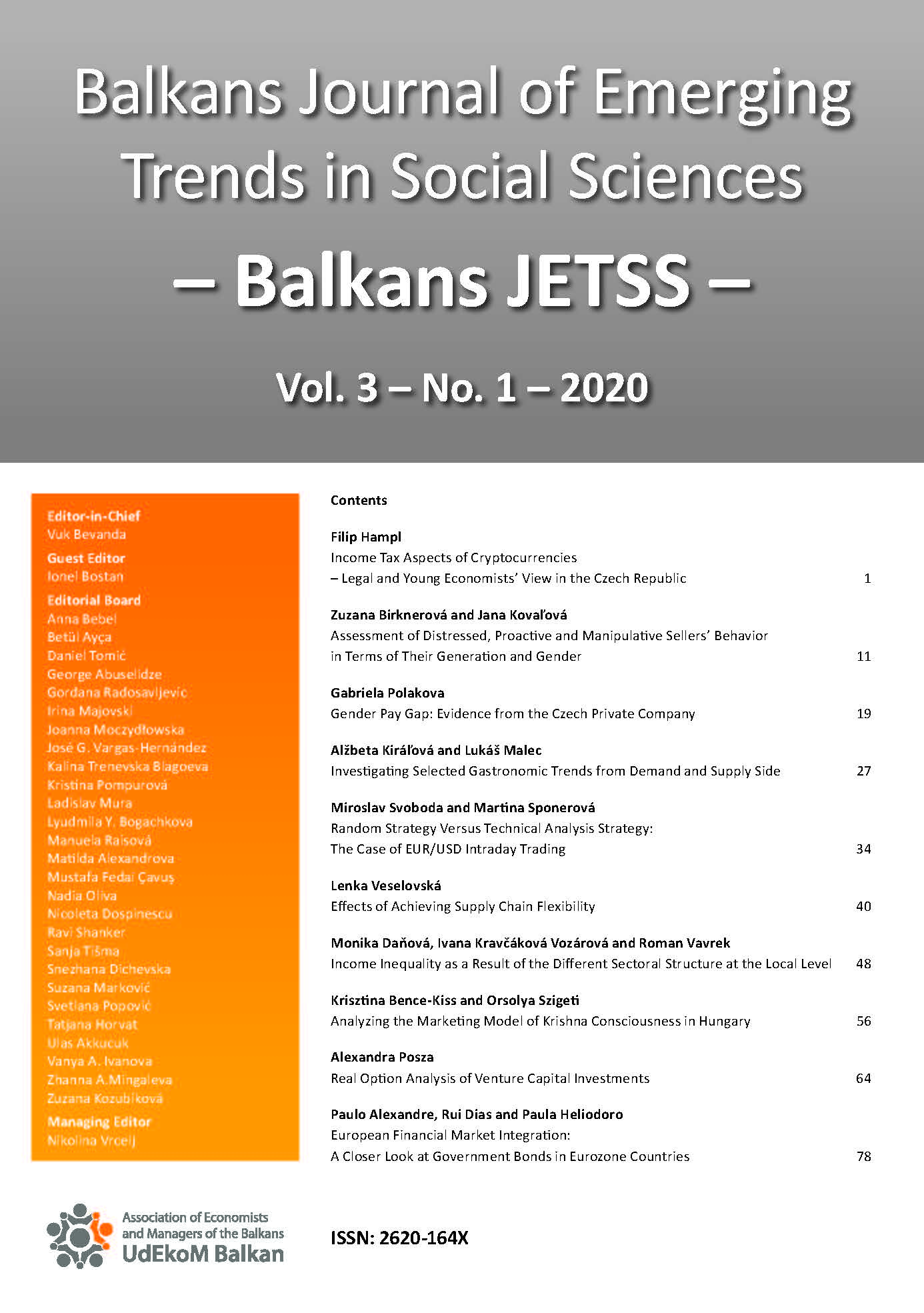

Journal: Balkans Journal of Emerging Trends in Social Sciences Balkans JETSS

- Issue Year: 3/2020

- Issue No: 1

- Page Range: 34-39

- Page Count: 6

- Language: English