REAL OPTION ANALYSIS OF VENTURE CAPITAL INVESTMENTS

REAL OPTION ANALYSIS OF VENTURE CAPITAL INVESTMENTS

Author(s): Alexandra PoszaSubject(s): Economy, National Economy, Business Economy / Management, Micro-Economics

Published by: Udruženje ekonomista i menadžera Balkana

Keywords: Real Option Theory; Strategic Flexibility; Uncertainty;

Summary/Abstract: Venture capital investments play an important role in the development and growth of start-up companies that are characterized by a high degree of uncertainty and growth potential, and venture capital is also one of the major sources of financing for entrepreneurial businesses. In the case of venture capital investment, staging has a huge potential, so the venture capitalists keep the right to participate in further financing rounds. The real option approach as an evaluation method provides an opportunity to evaluate this kind of investment with the help of flexibility in the case of a high degree of uncertainty. The paper puts the emphasis on the evaluation and the effectiveness of venture capital investments primarily from the aspect of real option theory tested on Hungarian venture capital cases. The paper concludes that the option-based valuation methods are more suitable for evaluating venture capital investments than others, especially the discounted cash flow method.

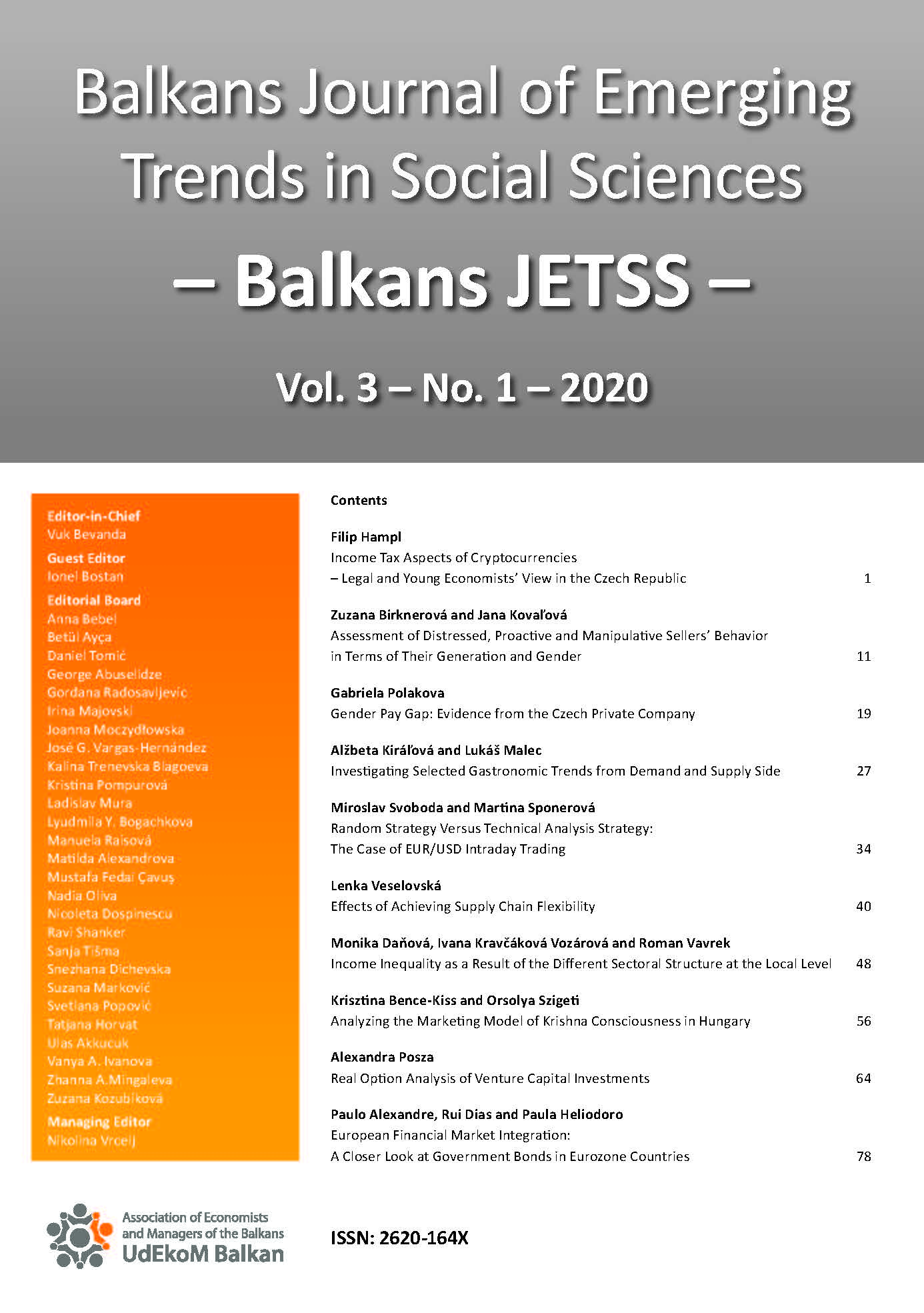

Journal: Balkans Journal of Emerging Trends in Social Sciences Balkans JETSS

- Issue Year: 3/2020

- Issue No: 1

- Page Range: 64-77

- Page Count: 14

- Language: English