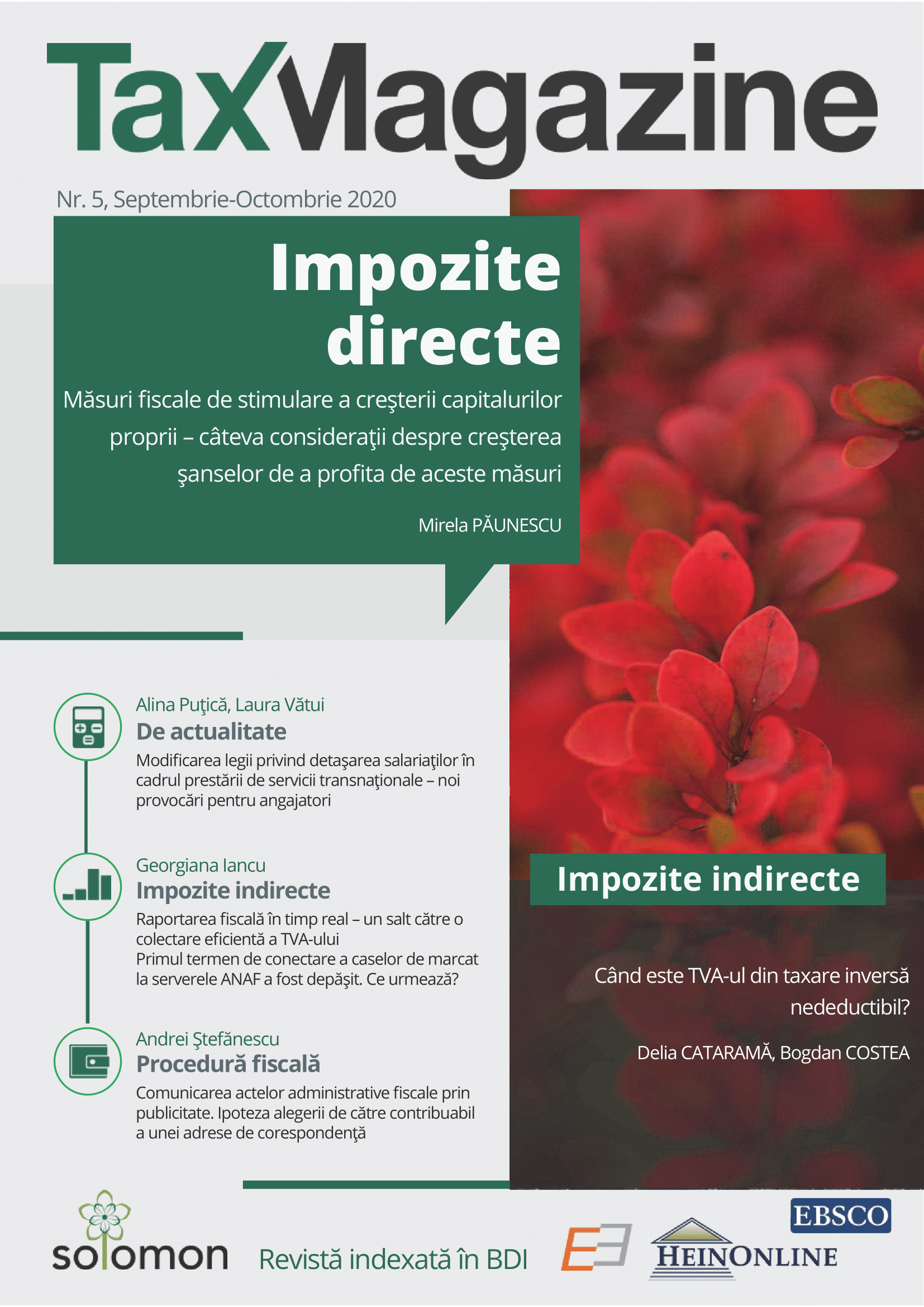

Măsuri fiscale de stimulare a creșterii capitalurilor proprii – câteva considerații despre creșterea șanselor de a profita de aceste măsuri

Tax measures to stimulate the growth of equity – some considerations about increasing the chances of taking advantage of these measures

Author(s): Mirela PăunescuSubject(s): Law, Constitution, Jurisprudence, Civil Law

Published by: Editura Solomon

Keywords: Tax measures; equity; Romanian economy;

Summary/Abstract: Considered as one of the serious issues of the Romanian economy, the topic of companies reporting for the equity smaller values than those required by the law was of most interest for the Romanian authorities over the years. If, in the previous years, such companies were threatened with penalties in case of noncompliance with the requirement to increase the equity, in the year of 2020, the authorities switched their approach to offering tax stimulus for companies increasing their equity. This tax measure is not original as it was reported in other European countries as well. In the next article we aim to analyze some scenarios of restructuring the equity reported for the year 2020, scenarios still possible until the end of the year. The reason for our analysis is to identify opportunities for companies to obtain the tax relieves available or to increase their values. Among the scenarios examined are the distribution of dividends, settling the reported losses or increasing the equity.

Journal: Tax Magazine

- Issue Year: 2020

- Issue No: 5

- Page Range: 345-353

- Page Count: 9

- Language: Romanian

- Content File-PDF