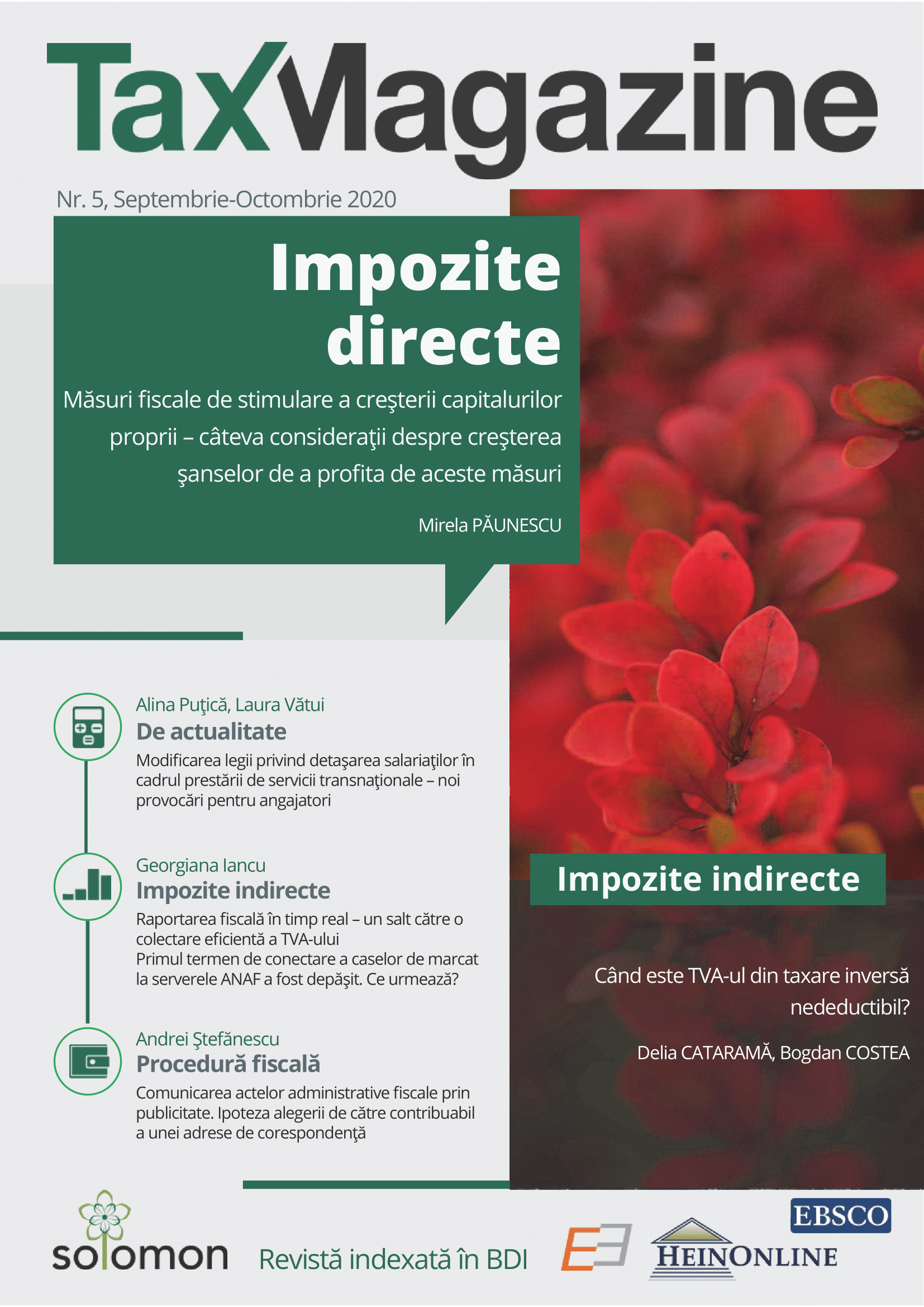

Când este TVA-ul din taxare inversă nedeductibil?

When is the reverse charge VAT non-deductible?

Author(s): Delia Cataramă, Bogdan CosteaSubject(s): Law, Constitution, Jurisprudence, Commercial Law

Published by: Editura Solomon

Keywords: VAT; Value Added Tax; no obligation to charge VAT; non‑deductible;

Summary/Abstract: The reverse charge mechanism is a process known in Value Added Tax (VAT), by which the seller issues the invoice without charging VAT, as it is the obligation of the buyer to collect VAT. Once this VAT has been charged, it must be analyzed to what extent it can be deducted, similar to any other VAT! But we often face the situation in which the tax audits consider this VAT charged by reverse charge as non‑deductible, although there was no obligation to charge VAT in the first place. Thus, we arrive to the absurd situation in which for a transaction for which there would have been no obligation to charge VAT, the tax authority imposes to the taxpayer to charge and not deduct, thus increasing his tax burden. We investigate in this article which are the situations in which a certain VAT that has been charged by reverse charge can be considered non‑deductible.

Journal: Tax Magazine

- Issue Year: 2020

- Issue No: 5

- Page Range: 354-365

- Page Count: 12

- Language: Romanian

- Content File-PDF