Organele fiscale nu pot stabili obligații fiscale pentru o perioadă mai mare de cinci ani. Recurs în interesul legii soluționat de Înalta Curte de Casație și Justiție

The tax bodies may not impose liabilities representing income tax for a period of time exceeding five years. Appeal in the interest of the law settled by the High Court of Cassation and Justice

Author(s): Emanuel BăncilăSubject(s): Law, Constitution, Jurisprudence, Civil Law

Published by: Editura Solomon

Keywords: tax bodies; income tax; Fiscal Procedure Code; taxable income;

Summary/Abstract: By its Decision no. 21 of September 14, 2020, given in file no. 1375/1/2020, the High Court of Cassation and Justice allowed the appeal in the interest of the law filed with regard to the tax body’s right to impose additional liabilities and noted that such liabilities may be computed for a period of five years, that starts running on January 1st of the year following the fiscal year in which the taxable income from which results the income tax due by the taxpayer was obtained. This decision puts an end to a long dispute over the interpretation of the provisions of O.G. no. 92/2003 on the Fiscal Procedure Code regarding the moment from which the prescription term of the fiscal body’s right to establish additional obligations is calculated.

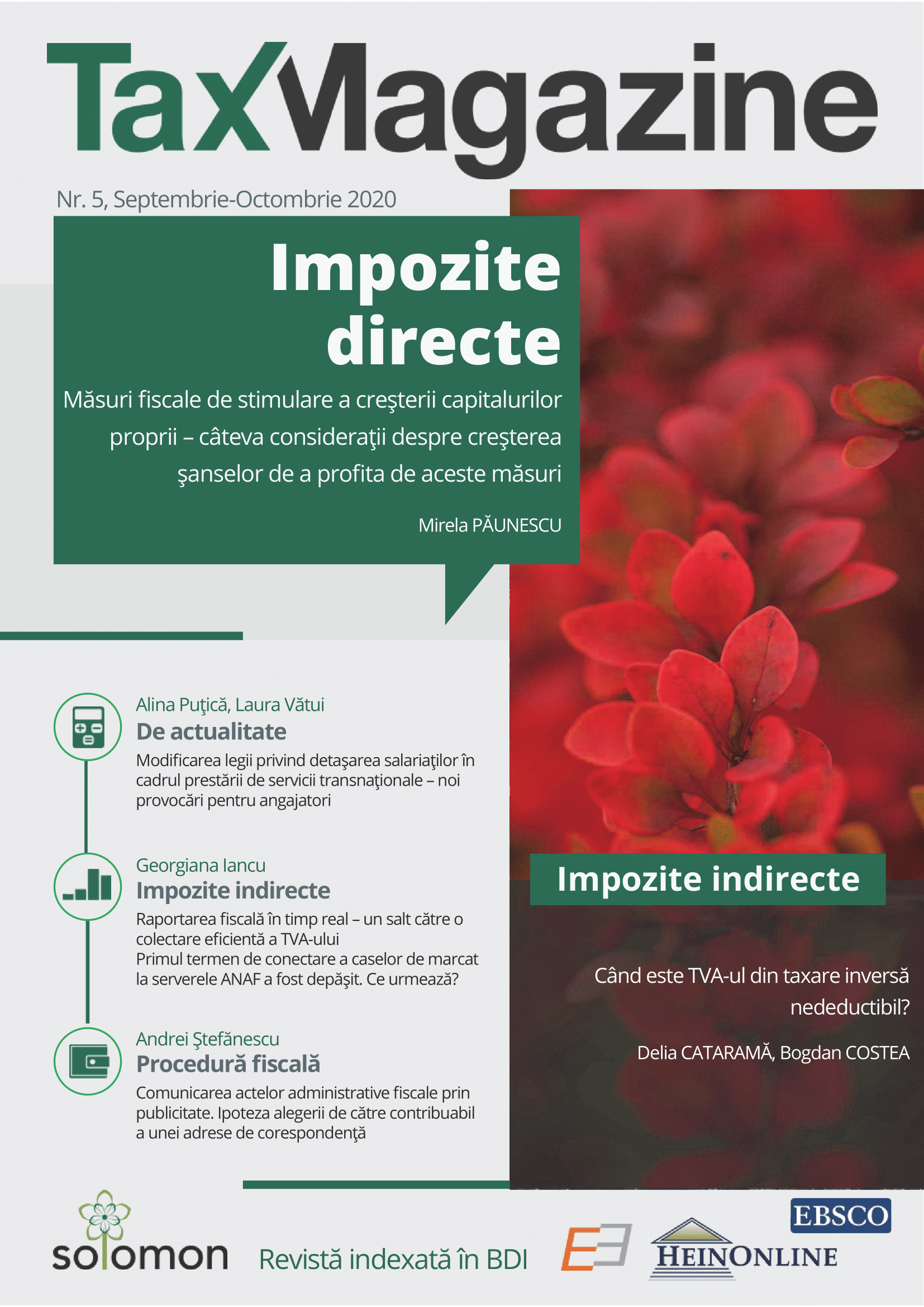

Journal: Tax Magazine

- Issue Year: 2020

- Issue No: 5

- Page Range: 372-374

- Page Count: 3

- Language: Romanian

- Content File-PDF