THE INFLUENCE OF BOARD INDEPENDENCE AND NTERNAL AUDIT FUNCTION ON COMPANY’S PERFORMANCE, STUDY OF MACEDONIAN COMPANIES

THE INFLUENCE OF BOARD INDEPENDENCE AND NTERNAL AUDIT FUNCTION ON COMPANY’S PERFORMANCE, STUDY OF MACEDONIAN COMPANIES

Author(s): Elena Bundaleska, Aleksandra Kocheska, Vladimir NaumovskiSubject(s): National Economy, Business Economy / Management, Financial Markets

Published by: Udruženje ekonomista i menadžera Balkana

Keywords: Corporate governance;Company performance;Independent board members;Internal audit function;Listed companies;

Summary/Abstract: Corporate governance and company performance are issues that continue to raise interests of the researchers worldwide, as they provide valuable lessons for vast audience, such as company owners, company leaders, supervisors and policy makers. This study aims towards contributing to the previous literature showing that there is positive correlation between corporate governance mechanisms and company performance. It specifically focuses on the correlation between board independence and internal audit function existence with performance of the companies listed on the Macedonian Stock Exchange, for specific periods 2003-2004 vs. 2014- 2018. In particular, the influence of the board independence and the internal audit function over company performance are investigated through Profit, Return on Equity (ROE) and Earnings per Share (EPS) indicators. The results of the performed research and analysis suggest that corporate governance is important for the company performance, i.e. corporate governance improvements such as board member independence and internal audit function have positive impact on the performance of the companies listed on the Macedonian Stock Exchange. However, given the fact that, other factors apart from board member independence and internal audit function can influence the Profit, ROE and EPS of companies, it is reasonable to assume that the increase of profit and of ROE and EPS indicators may not be connected exclusively with having independent board members and internal audit function. First and foremost, this study is of interest for company owners and leaders; yet, it also provides useful information for supervisors and other policy makers.

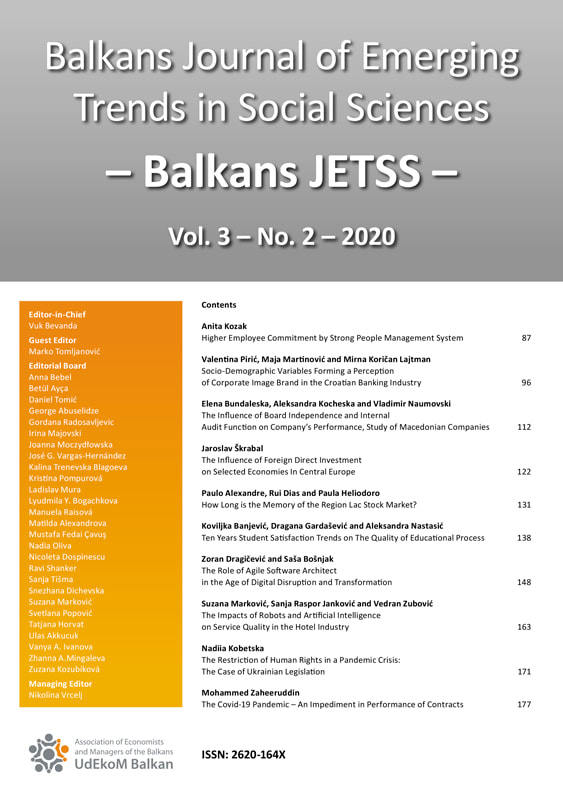

Journal: Balkans Journal of Emerging Trends in Social Sciences Balkans JETSS

- Issue Year: 3/2020

- Issue No: 2

- Page Range: 112-121

- Page Count: 10

- Language: English