MERGER AND ACQUISITION ANNOUNCEMENT OF INDIAN BANKING SECTOR: A PRE-POST ANALYSIS OF STOCK MARKET REACTION

MERGER AND ACQUISITION ANNOUNCEMENT OF INDIAN BANKING SECTOR: A PRE-POST ANALYSIS OF STOCK MARKET REACTION

Author(s): Mahesh Dahal, Joy DasSubject(s): Business Economy / Management, Methodology and research technology, Financial Markets

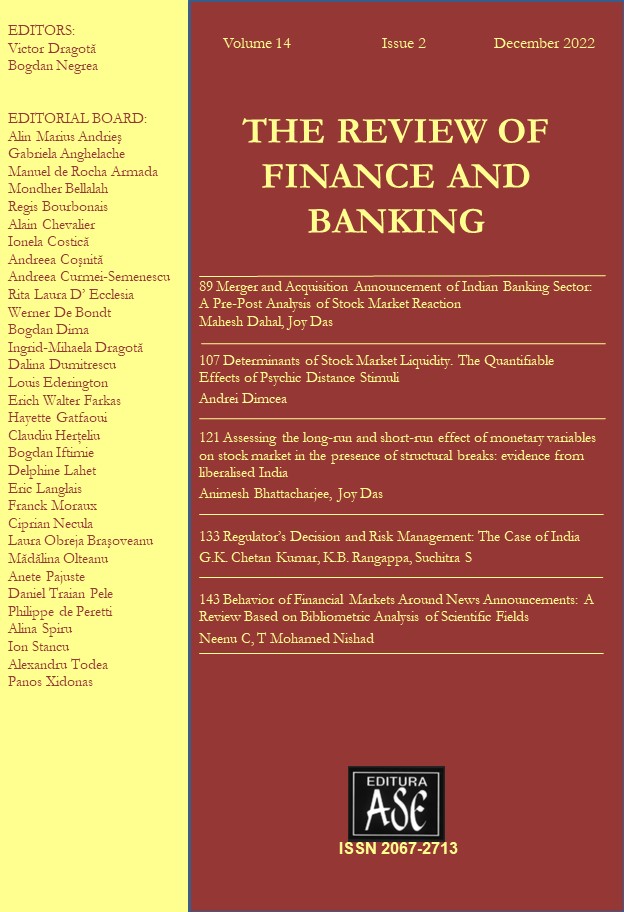

Published by: EDITURA ASE

Keywords: Merger and Acquisition; Indian Banking Companies; Event Study Methodology; BHAR;

Summary/Abstract: With the recommendation of the Narasimham Committee (1991), the Indian banking sector saw a soar in M&A with the objective of value creation, but the existing literature does not provide any conclusive evidence in respect of value creation for shareholders. Therefore, in the present study, an attempt has been made to investigate whether the M&A announcement generates value to the shareholders or not. By employing event study methodology, the study observed significant negative abnormal returns during the post-M&A announcement period for both overall market and individual banking sector stock. The returns further deteriorated in the long run with significant negative BHAR. Thus, the study concludes that the M&A did not create value to the shareholders; instead, it deteriorate the shareholders’ value.

Journal: The Review of Finance and Banking

- Issue Year: 14/2022

- Issue No: 2

- Page Range: 89-105

- Page Count: 15

- Language: English