ASSESSING THE LONG-RUN AND SHORT-RUN EFFECT OF MONETARY VARIABLES ON STOCK MARKET IN THE PRESENCE OF STRUCTURAL BREAKS: EVIDENCE FROM LIBERALISED INDIA

ASSESSING THE LONG-RUN AND SHORT-RUN EFFECT OF MONETARY VARIABLES ON STOCK MARKET IN THE PRESENCE OF STRUCTURAL BREAKS: EVIDENCE FROM LIBERALISED INDIA

Author(s): Animesh Bhattacharjee, Joy DasSubject(s): Economic policy, Methodology and research technology, Financial Markets, Fiscal Politics / Budgeting

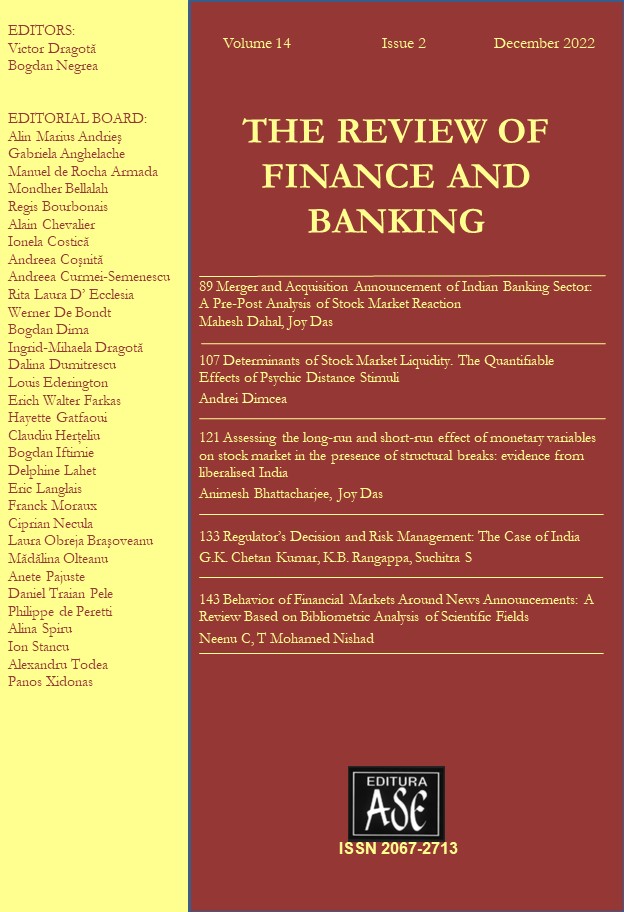

Published by: EDITURA ASE

Keywords: Monetary factors; ARDL-ECM; interest rate; monetary policy; Bai-Perron test multiple break point;

Summary/Abstract: The present study examines the long-run and short-run effects of monetary factors (money supply, interest rate, inflation, and foreign currency exchange rate) on the Indian stock market. The study uses sophisticated econometric tools to analyse monthly observations from January 1993 to December 2019. The Augmented Dickey Fuller (ADF) test indicates that the variables involved in the present study are either I(0) or I(1). The Bai-Perron multiple break point test identifies four breakpoint dates in the Indian stock market index series. The breakpoint dates are incorporated as different dummy variables in the ARDL-ECM regression. The F-bounds test reveals that the variables in the study are cointegrated within the time period under consideration. Our findings show that the interest rate, which is a proxy for monetary policy instrument, and the foreign currency exchange rate have a negative impact on the Indian stock market both in the long-run and short-run. Furthermore, we find that structural changes significantly affect the performance of Indian stock market. The study covers a long period of time, which the majority of previous work did not consider. Furthermore, the study uses different dummy variables in the ARDL model to represent structural breaks (as determined by the Bai-Perron multiple break point test).

Journal: The Review of Finance and Banking

- Issue Year: 14/2022

- Issue No: 2

- Page Range: 121-131

- Page Count: 11

- Language: English