Contractul de facilitate de credit şi cardul de debit, surse de haos în afaceri

The loan facility agreement and the debit card, sources of

chaos in business

Author(s): Gheorghe PipereaSubject(s): Law, Constitution, Jurisprudence

Published by: Universul Juridic

Keywords: credit facility; financer; client; group of contracts; termination; withdrawal; insolvency; debit card; issuer; user;

Summary/Abstract: This study examines the practical implications of the credit facility, regulated in art. 2.193-2.195 of the Civil Code, which represents the contract according to which a financer (credit institution, non-banking financial institution or other entity authorized by a special law) undertakes to make available a sum of money to the client, for a limited or unlimited period of time. Likewise, there are examined the payments made with a debit card, supposing a complex group of contracts, starting with the contract allowing the bank to issue cards, in a franchise system, continuing with the contract of issuing a debit card, which allows the user to make non-cash payments into the locations of the traders accepting payments made with a card, as the latter concluded contracts with their own banks which should allow them the processing of the collections from their clients being card users, as the respective banks concluded compensation and clearing agreements with the bank issuing the card. Both the analysis of the credit facility agreement and the analysis of the debit card are accompanied by the description of certain practical cases proving their potential to set up chaos sources in the business field.

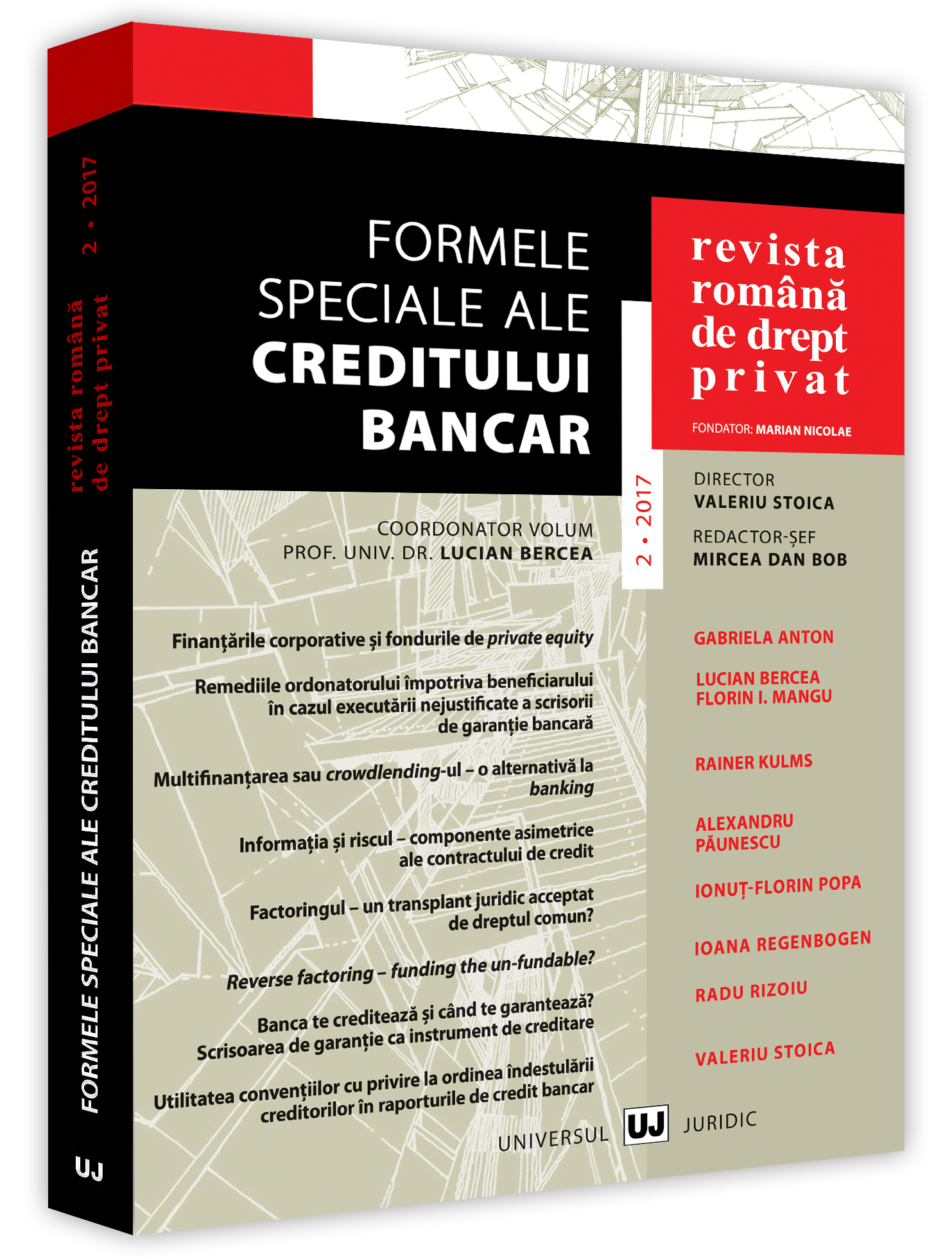

Journal: Revista Română de Drept Privat

- Issue Year: 2017

- Issue No: 02

- Page Range: 78-83

- Page Count: 6

- Language: Romanian

- Content File-PDF