THE GLOBAL PANDEMIC (COVID-19) HAS CAUSED LONG MEMORIES IN EUROPE’S BANKING SECTOR

THE GLOBAL PANDEMIC (COVID-19) HAS CAUSED LONG MEMORIES IN EUROPE’S BANKING SECTOR

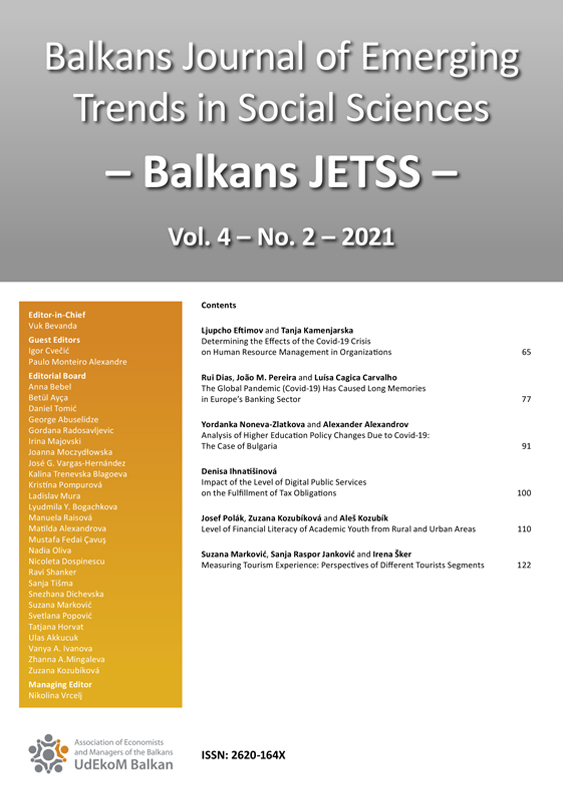

Author(s): Rui Dias, João Pereira, Luísa Cagica CarvalhoSubject(s): Economy, Financial Markets

Published by: Udruženje ekonomista i menadžera Balkana

Keywords: Covid-19;Banking sectors;Arbitrage;Portfolio diversification;

Summary/Abstract: This study aims to analyze the impact of the 2020 global pandemic on the banking sectors of the countries of France, Germany, Greece, Ireland, Italy, Portugal, and Spain for the period from January 1, 2018, to August 10, 2020, with the sample being split into two subperiods: first subperiod from January 2018 to August 2019 (Pre-Covid); and the second from September 2019 to August 2020 (Covid-19). Different approaches were undertaken to perform this analysis, in order to verify whether: (i) the global pandemic (Covid-19) accentuated the persistence, in the returns, of the European banking sectors? (ii) the presence of long memories increases the synchronizations between markets? The main findings show that the assumption of the market efficiency hypothesis may be challenged, due to the possible predictability of the banking sectors’ actions, and that the analyzed sectors also show marked levels of integration, thus questioning the hypothesis of efficient portfolio diversification. The results seem to be of interest to investors looking for opportunities in these specific sectors and for policymakers to carry out institutional reforms to increase efficiency and promote sustainable growth of financial markets.

Journal: Balkans Journal of Emerging Trends in Social Sciences Balkans JETSS

- Issue Year: 4/2021

- Issue No: 2

- Page Range: 77-90

- Page Count: 14

- Language: English