HOW LONG IS THE MEMORY OF THE REGION LAC STOCK MARKET?

HOW LONG IS THE MEMORY OF THE REGION LAC STOCK MARKET?

Author(s): Paulo Alexandre, Rui Dias, Paula HeliodoroSubject(s): National Economy, Supranational / Global Economy, Business Economy / Management, Financial Markets

Published by: Udruženje ekonomista i menadžera Balkana

Keywords: Covid-19;Market efficiency;Financial integration;Portfolio diversification

Summary/Abstract: Coronavirus Covid-19 is a type of outbreak that first appeared in December 2019 in the city of Wuhan, Hubei Province, China. It was declared a pandemic by the World Health Organization (WHO) on March 12, 2020. This trial aims to test the hypothesis of an efficient market, in its weak form, in the context of the global pandemic, in the financial markets of Argentina, Brazil, Chile, Co¬lombia, Peru, Mexico. The sample comprises daily data from July 2015 to June 2020 and is divided into two sub-periods pre and during Covid-19. The purpose of this analysis was to answer whether: i) the global pandemic (Covid-19) increased synchronization in the financial markets under analysis? ii) if so, could the persistence of profitability delimit the hypothesis of portfolio diversification? The results of the Gregory-Hansen test show very significant levels of integration in the periods before and during the Covid pandemic. In addition, we found that most of the breaks in structure are in March 2020. The results of the DFA exponents show that during the pre-Covid period, the Peruvian market shows persistence, suggesting signs of inefficiency (long memories), while the Argentinean market shows anti persistence, and the remaining markets show an equilibrium trend. In addition, we found that during the COVID period the Chilean and Colombia markets show very significant signs of inefficiency, with moderate signs of in (efficiency) the Argentinean, Brazilian and Peruvian markets. In addition, we verified that the Mexican market shows signs of anti-persistence. In conclusion, the emerging markets of Latin America show, for the most part, long persistent and significant memories during the Covid pandemic outbreak, that is, they show signs of in (efficiency). The authors consider that the results achieved are of interest to investors seeking opportunities in these stock exchanges, as well as to policy makers to carry out institutional reforms in order to increase the efficiency of stock markets and promote the sustainable growth of financial markets.

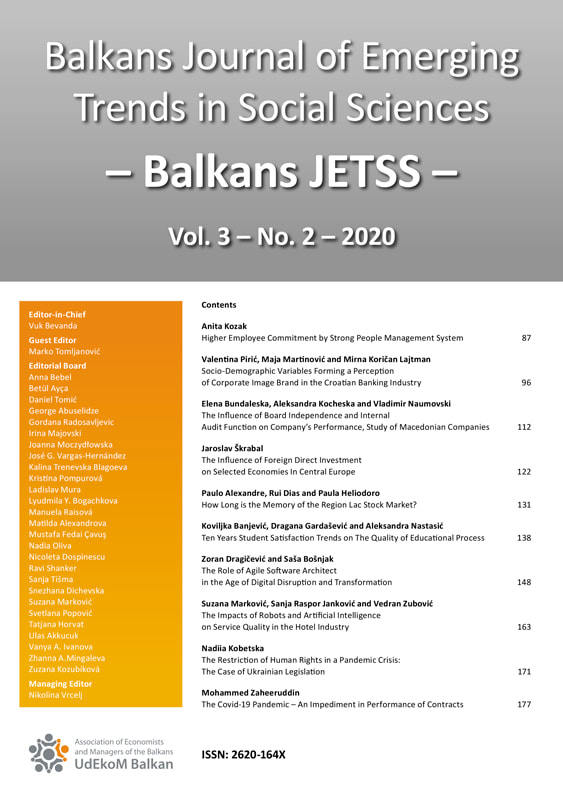

Journal: Balkans Journal of Emerging Trends in Social Sciences Balkans JETSS

- Issue Year: 3/2020

- Issue No: 2

- Page Range: 131-137

- Page Count: 7

- Language: English