EUROPEAN FINANCIAL MARKET INTEGRATION: A CLOSER LOOK AT GOVERNMENT BONDS IN EUROZONE COUNTRIES

EUROPEAN FINANCIAL MARKET INTEGRATION: A CLOSER LOOK AT GOVERNMENT BONDS IN EUROZONE COUNTRIES

Author(s): Paulo Alexandre, Rui Dias, Paula HeliodoroSubject(s): Economy, National Economy, Supranational / Global Economy, Financial Markets, Public Finances

Published by: Udruženje ekonomista i menadžera Balkana

Keywords: Interdependencies; Eurozone Debt Markets; Global Financial Crisis;

Summary/Abstract: This research aims to test the interdependencies between the Eurozone, US and Japanese debt markets, through the yields of 10-year sovereign bonds. The sample covers the period from 2002:01 to 2019:07. The analysis aims to provide answers to two questions: Has the global financial crisis accentuated the interdependencies in the Eurozone debt markets? If yes, how did it influence the movements in sovereign bond yields? The results suggest that the global financial crisis did not accentuate the levels of interdependence between the main Euro zone debt markets. In addition, the results suggest the existence of high movements in periods of crisis and not crisis. We also found that yields on PIIGS sovereign bonds decreased their interdependencies with their peers in the years 2002 to 2019, with the exception of the Greek debt market.

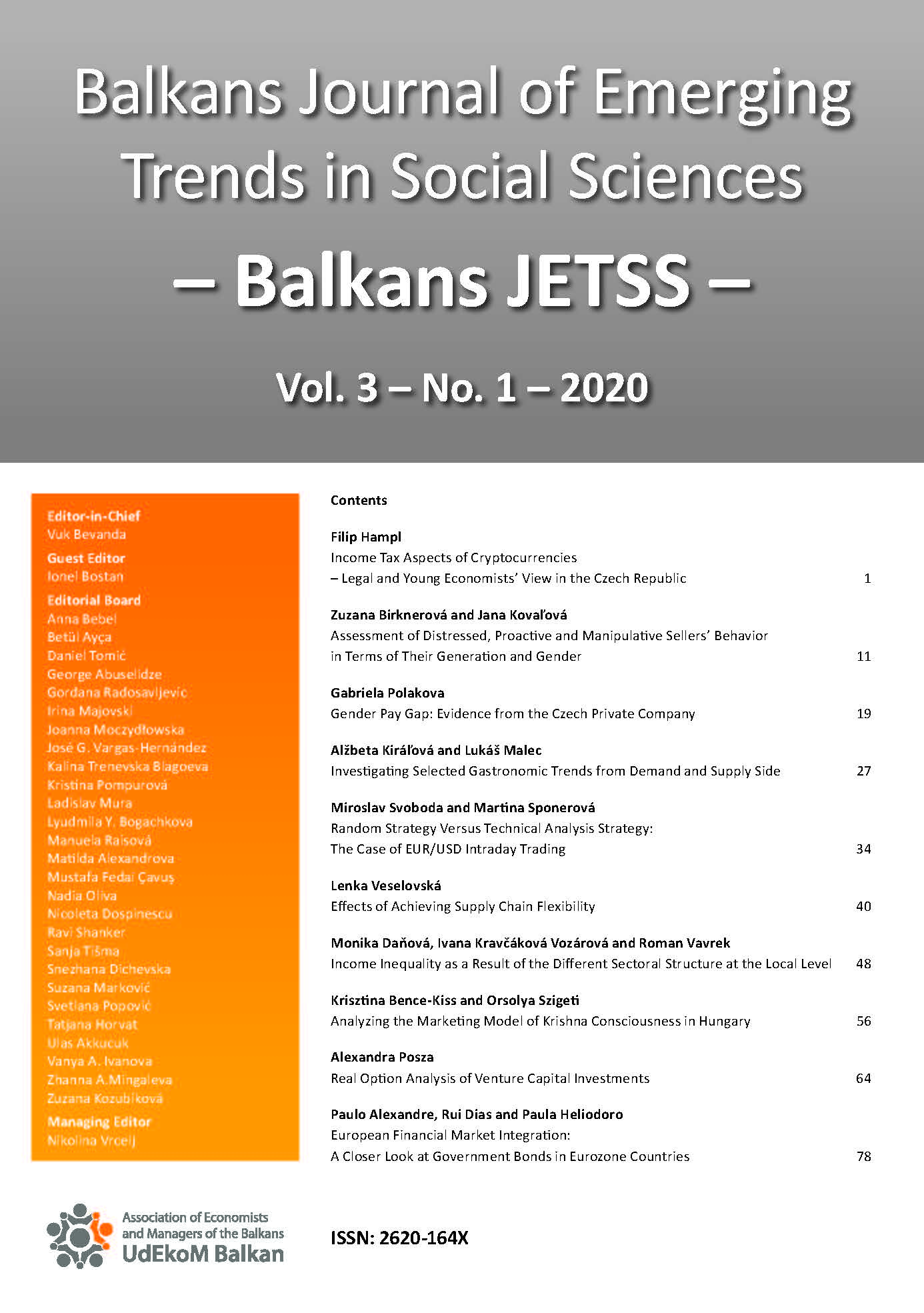

Journal: Balkans Journal of Emerging Trends in Social Sciences Balkans JETSS

- Issue Year: 3/2020

- Issue No: 1

- Page Range: 78-86

- Page Count: 9

- Language: English