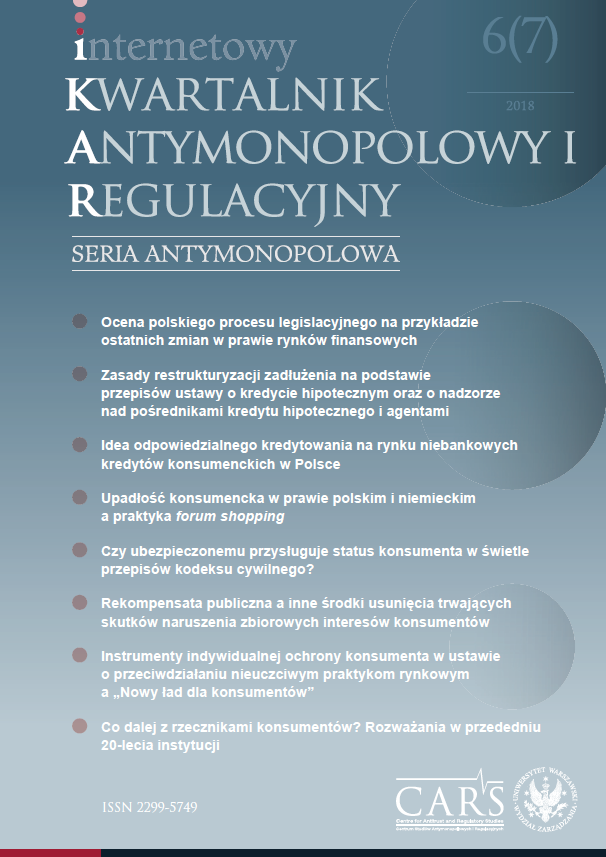

Idea odpowiedzialnego kredytowania na rynku niebankowych kredytów konsumenckich w Polsce

The idea of responsible lending on the non-bank consumer credit market in Poland

Author(s): Edyta Rutkowska-Tomaszewska, Magdalena PalecznaSubject(s): Economy, Law, Constitution, Jurisprudence, Business Economy / Management, Law on Economics

Published by: Wydawnictwo Naukowe Wydziału Zarządzania Uniwersytetu Warszawskiego

Keywords: consumer credit; consumer borrower; non-bank loan institution; lender; consumer protection; responsible lending; responsible lending by consumers; Consumer Credit Act; Directive 2008/48/EC;creditworthiness;

Summary/Abstract: The problem of responsible lending by creditors and consumers is increasingly far-reaching in the post-crisis reality because of the large scale of the phenomenon of consumer overindebtedness and its negative effects both individually and globally, as it generates excessive credit and even systemic risk. Responsible lending stops, therefore, being a mere postulate, and becomes the subject of regulation, and broadly understood jurisprudence, as well as very important social problems. The idea of responsible lending is implemented by a proper examination of the creditworthiness of the consumer by the lenders, both before granting the loan and during the loan. Consumers must also be informed of the terms of the loan agreement, in particular about the costs borne by the consumer, as well as of the legal and economic consequences of not doing so. The aim of this study is to present the idea of responsible lending on the part of lenders, such as non-bank lending institutions, as well as ways of its implementation and enforcement. The paper covers also its practical application by both lenders as well as competent institutions, the goal of which is to protect consumers not only against excessive indebtedness, but also against the occurrence of individual and systemic risk and against miss-selling on the non-bank consumer credit market. All this ultimately leads to a significant deterioration of the financial situation not only of consumers but also of lenders and, as a result, negatively affects the proper and stable functioning of this part of the financial services market (non-consumer consumer credit market and thus consumer credit market in general).

Journal: internetowy Kwartalnik Antymonopolowy i Regulacyjny (iKAR)

- Issue Year: 7/2018

- Issue No: 6

- Page Range: 38-52

- Page Count: 15

- Language: Polish